While many industries worldwide grapple with post-pandemic recovery challenges, Vietnam’s seafood sector is swimming upstream with remarkable success. The Vietnam Seafood Export Statistics 2025 reveal a story of resilience, innovation, and strategic market positioning that deserves your attention. Whether you’re an importer, distributor, or simply fascinated by international trade dynamics, these numbers paint a compelling picture of opportunity and growth.

The first seven months of 2025 have delivered impressive results that exceed most industry predictions, proving once again why Vietnam remains a powerhouse in global seafood trade. What makes these figures particularly exciting is how they reflect not just recovery, but genuine expansion into new territories and product categories. Let’s dive deep into the data that’s reshaping the global seafood landscape.

Outline

ToggleVietnam Seafood Export Statistics 2025: Overall Performance Overview

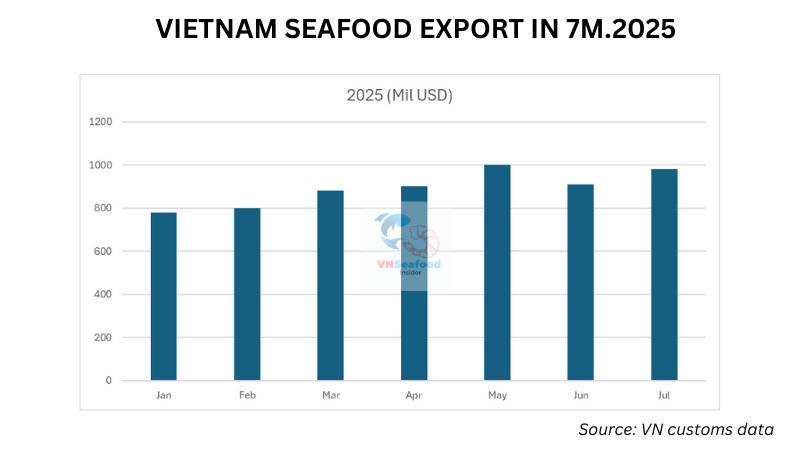

The headline numbers tell an impressive story that even seasoned industry veterans find remarkable. Vietnam’s seafood export revenue reached a substantial $6.2 billion during the first seven months of 2025, representing a robust 17% year-over-year growth compared to the same period in 2024. This performance significantly outpaces many economic forecasts and demonstrates the sector’s exceptional resilience.

To put this achievement in perspective, Vietnam has solidified its position as one of the world’s top seafood exporters, ranking consistently among the global top five. The Vietnam Seafood Export Statistics 2025 showcase how the country has successfully navigated challenging international waters, including fluctuating demand patterns and evolving consumer preferences across different markets.

The growth trajectory appears sustainable, with monthly export values showing consistent upward momentum throughout the January-July period. Industry analysts attribute this success to several factors: improved product quality, diversified market reach, and strategic investments in processing technology. The sector’s ability to maintain double-digit growth while competing against established exporters like Norway, Chile, and Thailand speaks volumes about Vietnamese seafood’s competitive advantages.

Looking at global seafood trade patterns, Vietnam’s performance stands out particularly when considering that many traditional seafood-consuming markets experienced economic uncertainties in early 2025. The country’s export success suggests strong demand fundamentals and effective market penetration strategies that have resonated with international buyers.

Product Category Breakdown: Vietnam Seafood Export Leaders

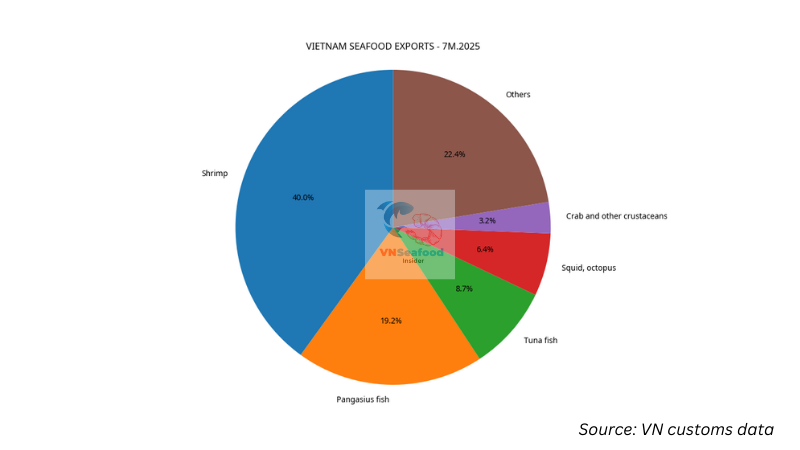

Understanding which products drive Vietnam’s export success requires examining the diverse portfolio that makes up the $6.2 billion total revenue. Each category tells its own story of market adaptation and consumer preference evolution.

Vietnam Shrimp Export Growth Dominates Statistics

Shrimp exports continue to reign supreme as Vietnam’s seafood crown jewel, generating $2.5 billion in export value with an impressive 24% growth rate. This exceptional performance reflects several market dynamics that you should know about. Vietnamese shrimp has gained significant competitive advantages, particularly in the US market, where recent developments have created unexpected opportunities.

Here’s where it gets interesting: the United States recently announced recalls of shrimp products from Indonesia due to radiation contamination concerns (according to FDA notice of Aug 22, 2025), while Indian shrimp faces high tariff barriers. These developments have positioned Vietnam shrimp exports as a safer, more reliable alternative for American importers seeking consistent supply chains and quality assurance.

The growth in shrimp exports also reflects Vietnam’s investment in sustainable aquaculture practices and improved processing facilities. Major shrimp-producing provinces have upgraded their cold chain logistics, ensuring product quality from farm to international market. This attention to detail has earned Vietnamese shrimp premium positioning in demanding markets like Japan and the European Union.

See more: Top 5 shrimp processing companies in Vietnam

Pangasius Fish Export Performance in 2025

Pangasius exports demonstrated steady growth with $1.2 billion in revenue and an 11% increase over the previous year. This performance is particularly noteworthy given the competitive pressures from other white fish alternatives in international markets. Vietnamese pangasius has successfully maintained its market share by focusing on product consistency and competitive pricing strategies.

The pangasius sector has also benefited from increasing acceptance in European markets, where consumers have gradually embraced this versatile fish as a sustainable protein option. Processing innovations have enabled Vietnamese exporters to offer value-added pangasius products, including pre-seasoned fillets and ready-to-cook portions that appeal to time-conscious consumers.

Other Key Product Categories

The remaining product categories collectively contribute $2.3 billion to Vietnam’s export portfolio, showcasing remarkable diversity. Tuna exports reached $542 million, though experiencing a slight 3% decline that reflects global tuna market challenges and increased competition from Pacific Island nations.

Squid and octopus exports bounced back strongly with $402 million in revenue and 16% growth, driven primarily by recovered demand from Asian markets, particularly South Korea and Japan. Meanwhile, crab and other crustaceans achieved the highest growth rate at 28%, reaching $200 million in export value as premium seafood demand resurged in post-pandemic dining sectors.

Top Import Markets: Vietnam Seafood Export Statistics 2025 by Destination

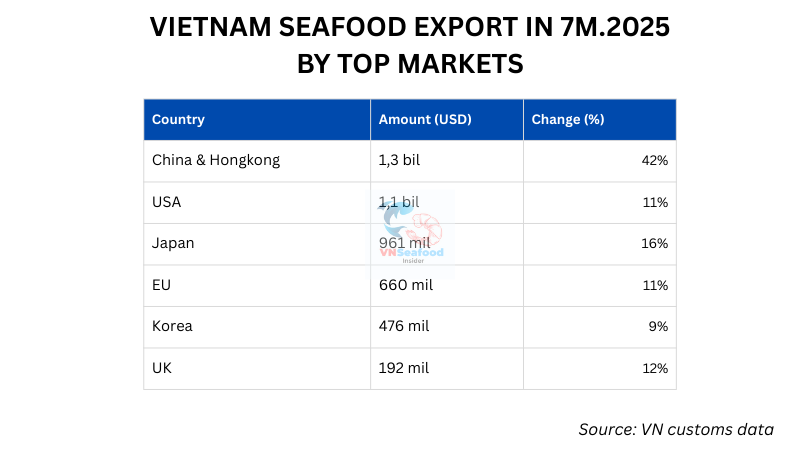

Vietnam’s export success stems from strategic market diversification that reduces dependency on any single destination. The top import markets for Vietnamese seafood reveal fascinating patterns of global demand and trade relationship evolution.

Seafood Import Market China 2025 Leads Growth

China and Hong Kong emerged as Vietnam’s largest seafood importers, accounting for $1.3 billion in purchases with an extraordinary 42% growth rate. This surge reflects several factors: China’s economic recovery, increased domestic seafood consumption, and Vietnam’s proximity advantage for fresh and live seafood products.

The China market’s growth is particularly significant because it demonstrates Vietnamese exporters’ ability to meet the specific quality and species preferences of Chinese consumers. Live seafood transport capabilities have improved dramatically, enabling Vietnamese suppliers to serve high-end restaurants and premium retail markets in major Chinese cities.

Established Markets Show Steady Growth

Traditional markets continue showing healthy demand patterns. The United States imported $1.1 billion worth of Vietnamese seafood with 11% growth, while Japan reached $961 million with 16% growth. The European Union collectively imported $660 million worth of products, also growing at 11%.

South Korea and the United Kingdom round out the top six import destinations with $476 million (9% growth) and $192 million (12% growth) respectively. These figures demonstrate Vietnam’s successful penetration of diverse market segments, from price-sensitive bulk buyers to premium quality-focused importers.

Market Analysis: Factors Driving Vietnam Seafood Export Growth

Several key factors contribute to Vietnam’s outstanding seafood export performance in 2025. The primary driver remains the country’s competitive production costs combined with improving product quality standards. Vietnamese processors have invested heavily in modernizing facilities, implementing international food safety certifications, and developing sustainable aquaculture practices.

Trade agreements play a crucial role in Vietnam’s export success. The EVFTA (EU-Vietnam Free Trade Agreement), CPTPP (Comprehensive and Progressive Trans-Pacific Partnership), and UKVFTA (UK-Vietnam Free Trade Agreement) provide significant tariff advantages that make Vietnamese seafood more competitive in these markets. These agreements have effectively reduced trade barriers and streamlined customs procedures.

Currency exchange rates have also favored Vietnamese exporters, making their products more attractive to international buyers seeking value-for-money options. The Vietnamese dong’s stability against major trading currencies has provided predictable pricing for long-term contracts, encouraging sustained buying relationships.

Technology adoption across the seafood value chain has enhanced Vietnam’s export capabilities. From GPS-tracked fishing vessels to blockchain-enabled traceability systems, Vietnamese seafood companies have embraced innovations that meet increasingly sophisticated buyer requirements for transparency and sustainability.

Challenges and Risk Factors for Vietnam Seafood Exporters

Despite impressive growth figures, top Vietnamese seafood exporters face several challenges that could impact future performance. Global geopolitical tensions create uncertainty in international trade relationships, potentially affecting established supply chains and buyer preferences.

Supply chain disruptions remain a persistent concern, particularly for logistics and cold chain management. Rising fuel costs and shipping delays can significantly impact profit margins for seafood exporters who depend on timely delivery to maintain product quality.

Market volatility presents ongoing challenges as seafood prices fluctuate based on seasonal availability, weather patterns, and changing consumer demands. Competition from other major exporting countries like Thailand, Indonesia, and Ecuador requires continuous innovation and cost optimization to maintain market share.

Environmental regulations and sustainability requirements are becoming increasingly stringent across major import markets. Vietnamese exporters must invest in eco-friendly practices and obtain relevant certifications to access premium market segments, adding operational costs but ensuring long-term market access.

Future Outlook: Vietnam Seafood Export Projections 2025-2026

The outlook for Vietnamese seafood exports remains optimistic as several positive trends converge to support continued growth. Value-added seafood products present the greatest opportunity for revenue expansion, as consumers increasingly seek convenient, ready-to-eat options that command higher profit margins.

Market expansion in ASEAN countries and recovered economies like Japan offers significant potential. Vietnamese exporters are well-positioned to capitalize on regional trade agreements and cultural similarities that facilitate business relationships in these markets.

Investment in technology and processing capabilities continues to enhance Vietnam’s competitive position. Automation, improved cold storage facilities, and advanced packaging technologies will enable Vietnamese seafood companies to meet evolving international standards while maintaining cost advantages.

Sustainability initiatives and eco-certifications are becoming essential for accessing premium markets. Vietnamese seafood companies that invest early in sustainable practices and obtain relevant certifications will gain competitive advantages in environmentally conscious markets like Europe and North America.

See more: Inside Vietnam Pangasius Farming What Every Seafood Importer Must Know Before Buying

Conclusion

The Vietnam Seafood Export Statistics 2025 paint a picture of remarkable success and promising future prospects. With $6.2 billion in export revenue and 17% growth in just seven months, Vietnam has demonstrated its resilience and competitive strength in global seafood markets.

At VNSeafoodInsider, we’re particularly excited about the opportunities these statistics represent for international buyers and Vietnamese exporters alike. The combination of product diversity, market reach, and continued investment in quality improvements positions Vietnam as a reliable long-term seafood supplier for global markets.

As we move through the remainder of 2025 and into 2026, the foundation has been laid for sustained growth, making Vietnamese seafood an increasingly attractive option for importers seeking quality, reliability, and competitive pricing in their supply chains.

Pingback: Brazil Pangasius Market Surge 64% Drives Vietnam Fish Export

Pingback: Pangasius Export Prices Set to Rise in Q4 2025

Pingback: Seafood Quality Control Vietnam: How to Avoid Oversoaked Products