When VNSeafoodInsider first started tracking Vietnam’s pangasius exports, we never imagined witnessing such a dramatic shift in global trade patterns. The numbers coming out of Brazil pangasius market this year tell a story that’s reshaping everything we thought we knew about international seafood markets – and it’s a story you definitely want to hear.

Outline

ToggleVietnam Pangasius Export Statistics: Record-Breaking Performance

The first seven months of 2025 have delivered some truly remarkable figures that showcase Vietnam’s resilience and adaptability in global markets. According to Vietnam Customs data, the country’s total Vietnam pangasius export statistics paint a picture of sustained growth despite global economic uncertainties.

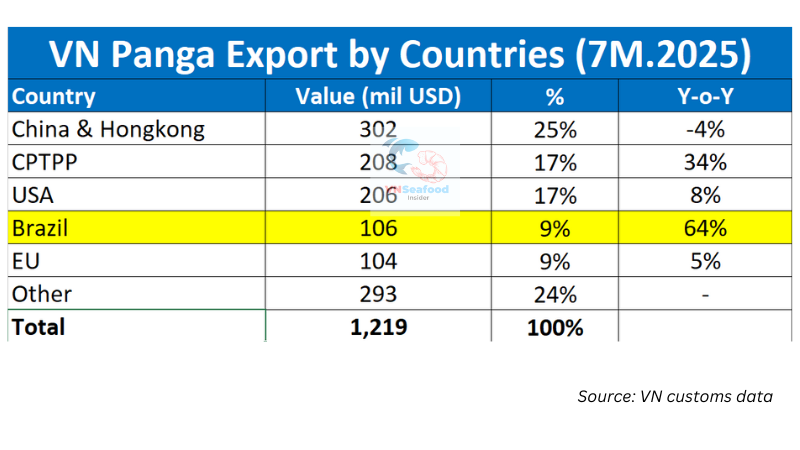

Vietnam’s pangasius exports reached an impressive $1.2 billion during the first seven months of 2025, marking an 11% year-over-year increase that exceeded most industry predictions. This growth trajectory demonstrates the sector’s remarkable ability to navigate complex international trade dynamics while maintaining competitive positioning across diverse markets.

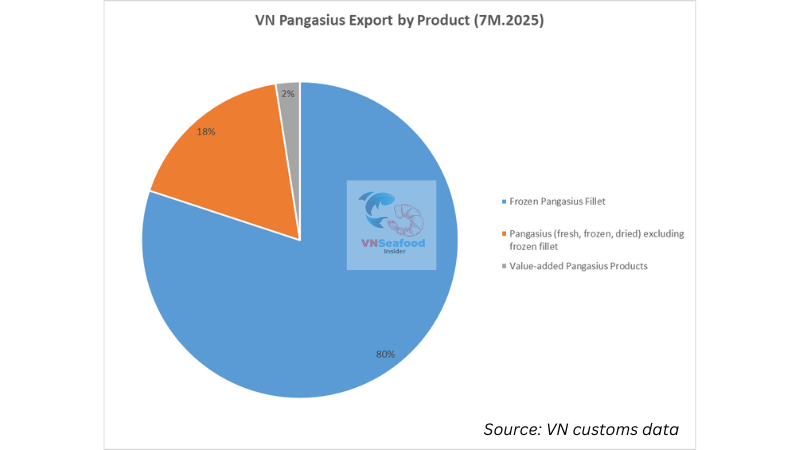

Breaking down the product categories reveals interesting consumption patterns worldwide. Frozen pangasius fillets under HS code 0304 dominated exports with $976 million in value, representing an 11% growth rate that mirrors the overall sector performance. This consistency suggests stable demand for Vietnam’s flagship pangasius product across multiple markets.

The dried and other frozen products category (HS 03, excluding 0304) generated $213 million with a 7% growth rate, indicating steady but more moderate expansion in these traditional product lines. However, the real standout performer was value-added products under HS code 16, which achieved $30 million in exports with an extraordinary 41% growth rate.

This dramatic surge in value-added products signals a strategic shift that VNSeafoodInsider has been advocating for years – Vietnamese producers are finally capturing more value in the supply chain. By focusing on processed, ready-to-eat pangasius products, Vietnamese exporters are reducing their vulnerability to raw material price fluctuations while commanding premium prices in international markets.

The diversification across product categories also demonstrates Vietnam’s sophisticated understanding of different market preferences. While traditional markets might prefer basic frozen fillets, emerging markets often show stronger appetite for convenient, processed options that align with busy modern lifestyles.

See more: Inside Vietnam Pangasius Farming What Every Seafood Importer Must Know Before Buying

Pangasius Global Market Trends: Winners and Challenges

The global landscape for Vietnamese pangasius reveals a fascinating mix of established strongholds and emerging opportunities that reflect broader pangasius global market trends reshaping international seafood commerce.

China and Hong Kong maintained their position as Vietnam’s largest pangasius market, importing $302 million worth of products – representing nearly 25% of total Vietnamese pangasius exports. However, the 4% decline compared to the same period last year signals cooling demand, particularly for whole fish and basic frozen fillets. This softening reflects broader economic pressures in China and shifting consumer preferences toward premium seafood options.

The CPTPP bloc emerged as the year’s biggest success story, with imports surging 34% to reach $208 million. This remarkable growth stems from preferential trade agreements that reduce tariff barriers, making Vietnamese pangasius more competitive against alternative protein sources. Countries like Canada and Malaysia are driving much of this growth, supported by stable consumer demand and favorable economic conditions.

The United States maintained steady performance with $206 million in imports, representing an 8% increase that demonstrates consistent American appetite for Vietnamese pangasius. However, July alone saw a slight 0.3% decline to $31 million, raising questions about potential impacts from evolving trade policies and tariff discussions.

The European Union delivered solid but unspectacular performance with $104 million in imports, up 5% year-over-year. Spain, Belgium, Italy, and France showed strong growth that offset declining demand in Germany and the Netherlands, highlighting the importance of market diversification even within regional blocs.

These shifting patterns reflect broader changes in global seafood consumption, trade policy evolution, and economic conditions across different regions. Vietnamese exporters are adapting by developing market-specific strategies that account for local preferences, regulatory requirements, and competitive dynamics.

See more: Vietnam Seafood Export Statistics 2025

Brazil Pangasius Market: The Standout Success Story

Now here’s where things get really interesting – the Brazil pangasius market has absolutely exploded this year, and VNSeafoodInsider believes this trend represents a fundamental shift in South American seafood consumption patterns.

Brazilian imports of Vietnamese pangasius reached $106 million during the first seven months of 2025, representing a staggering 64% increase compared to the same period in 2024. This exceptional performance catapulted Brazil into the fourth-largest market position for Vietnamese pangasius, surpassing several traditional importers that have been buying Vietnamese fish for decades.

What makes Brazil’s growth so remarkable isn’t just the numbers – it’s the speed and consistency of market penetration. While established markets like China show signs of maturity or decline, Brazil demonstrates the characteristics of an emerging market hitting its growth stride. The 64% increase suggests Brazilian consumers and businesses are rapidly discovering and adopting Vietnamese pangasius as their preferred white fish option.

This growth trajectory positions Brazil as a critical diversification success for Vietnamese exporters who have been seeking alternatives to over-dependence on traditional markets. The Brazil pangasius market offers something that mature markets often can’t – room for substantial expansion without intense competition from established suppliers.

Comparing Brazil’s performance with other major markets reveals the dramatic difference. While the US grew 8% and the EU managed 5%, Brazil’s 64% growth rate demonstrates exponentially higher potential for Vietnamese exporters willing to invest in market development and local relationship building.

The timing couldn’t be better for Vietnamese producers. As traditional markets face various challenges – from trade policy uncertainties to economic slowdowns – Brazil emerges as a bright spot offering both immediate returns and long-term growth potential that could reshape Vietnam’s export strategy for years to come.

Why Pangasius Dominates Brazilian Seafood Preferences

The success story in Brazil isn’t just about numbers – it’s about understanding why Vietnamese pangasius has become the number one white fish choice for Brazilian seafood import demand.

Brazilian consumers are experiencing a significant transformation in their seafood consumption patterns, driven by urbanization, rising incomes, and changing lifestyle preferences. The bustling metropolis of São Paulo, Brazil’s wealthiest and most populous city, has emerged as the trendsetter for the entire country’s seafood consumption habits.

Urban Brazilian consumers increasingly seek convenient, processed seafood products that align with their fast-paced lifestyles. Frozen pangasius fillets and value-added products perfectly match this demand, offering consistent quality, competitive pricing, and versatility in cooking applications. Health-conscious Brazilian consumers appreciate pangasius’s lean protein profile and nutritional benefits compared to traditional protein sources.

The cultural shift toward international cuisine and global food trends has also created opportunities for Vietnamese pangasius. Brazilian restaurants and foodservice operators are embracing pangasius for its neutral flavor profile that works well with traditional Brazilian seasonings and cooking methods.

Brazilian Seafood Import Demand: Market Drivers

Several demographic and economic factors are driving sustained Brazilian seafood import demand that benefits Vietnamese pangasius exporters.

Brazil’s growing middle class has more disposable income to spend on premium protein sources, including imported seafood. Urban populations are expanding rapidly, creating concentrated markets where imported products can achieve efficient distribution and marketing scale.

The country’s retail infrastructure has evolved significantly, with modern supermarket chains and cold storage facilities enabling better handling of frozen seafood products. This infrastructure development reduces spoilage risks and extends product shelf life, making imported pangasius more viable for Brazilian retailers.

Foodservice sector expansion, including restaurants, hotels, and institutional catering, creates bulk purchasing opportunities for Vietnamese exporters. These professional buyers often prioritize consistent supply, standardized quality, and competitive pricing – all strengths of Vietnamese pangasius suppliers.

See more: Top 20 biggest seafood companies in vietnam

Market Access and Regulatory Progress

Brazil’s Ministry of Agriculture, Livestock and Food Supply (MAPA) has made significant strides in opening the market for Vietnamese pangasius products, creating the regulatory foundation for continued growth. Please note that all pangasius products shipped to Brazil are required to have DIPOA registration for packaging before shipment.

Recent decisions by MAPA to approve specific Vietnamese pangasius products demonstrate growing confidence in Vietnam’s production standards and pangasius quality control systems. Technical negotiations between Vietnamese and Brazilian authorities continue focusing on expanding approved product categories to include all types of pangasius fillets meeting international standards.

The progress toward full market access represents years of diplomatic and technical cooperation between both countries. Vietnamese exporters have successfully demonstrated compliance with Brazilian food safety requirements and international best practices.

Future market access opportunities could include fresh chilled products, specialized cuts, and additional value-added categories that would further expand Vietnamese presence in Brazilian retail and foodservice markets.

Strategic Outlook and Market Opportunities

Looking ahead, the Brazil pangasius market success story offers valuable lessons for Vietnamese exporters about the benefits of geographic diversification and market development investment.

Brazil’s exceptional growth demonstrates that emerging markets can provide alternatives to over-dependence on traditional importing countries. This diversification strategy enhances trade policy resilience by reducing vulnerability to disputes or regulatory changes in any single market.

The strong performance of value-added products in Brazil suggests significant potential for Vietnamese producers to capture higher margins through processing and product innovation. Brazilian consumers appear willing to pay premium prices for convenience and quality.

Long-term sustainability factors favor continued Vietnamese success in Brazil, including growing population, rising incomes, urbanization trends, and infrastructure development. These fundamentals suggest that the current 64% growth rate, while exceptional, reflects genuine market expansion rather than temporary factors.

VNSeafoodInsider believes that Brazil represents just the beginning of a broader shift toward South American markets that could reshape Vietnam’s pangasius export strategy. The success in Brazil provides a blueprint for expansion into neighboring countries with similar demographic and economic characteristics.

As we watch these trends unfold, one thing becomes clear: Vietnamese pangasius exporters who embrace market diversification and invest in understanding local consumer preferences will be the ones capturing the biggest opportunities in tomorrow’s global seafood markets.