When VNSeafoodInsider walks through aquaculture farms across the Mekong Delta, one question keeps surfacing among farmers: “Why do feed prices keep squeezing our profits?” It’s a valid concern that touches every corner of Vietnam’s booming aquaculture industry. The feed cost impact on fish and shrimp production has become the silent giant in the room—accounting for more than half of what farmers spend to bring seafood from pond to plate.

Understanding these costs isn’t just about numbers on a spreadsheet. It’s about the livelihoods of thousands of Vietnamese farmers competing in a global market where every cent matters. From the corn fields of America to the cassava farms of Vietnam, ingredient prices ripple through the entire supply chain. Let’s break down how feed costs shape the economics of aquaculture and what it means for Vietnam’s seafood future.

Outline

ToggleThe Dominant Role of Feed Cost Impact in Aquaculture Economics

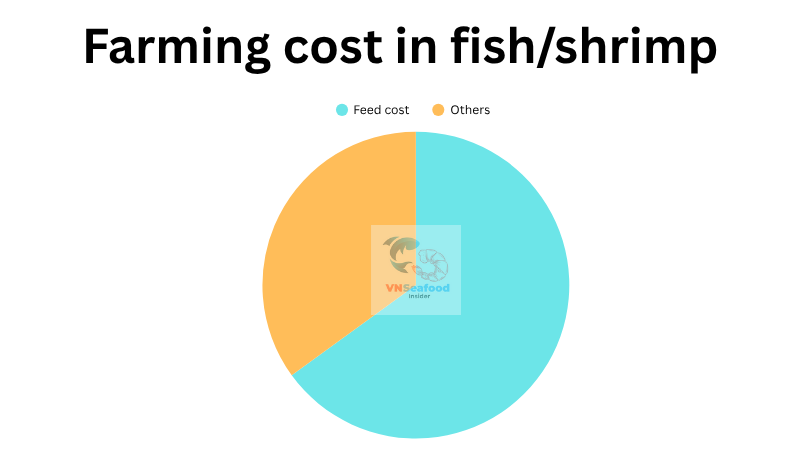

Here’s something that might surprise you: feed costs represent 50-70% of total aquaculture production expenses across Vietnam. That’s not a typo—more than two-thirds of what farmers invest goes straight into feeding their stock.

Feed Cost Percentages Across Major Species

Take pangasius farming, Vietnam’s golden child of aquaculture exports. Pangasius feed costs consume 60-70% of total production expenses—a staggering proportion that leaves little room for error. The math is simple but unforgiving: farmers need approximately 1.8 kg of feed to produce 1 kg of marketable fish. This feed conversion ratio (FCR) directly determines whether a farm turns profit or struggles to break even.

Tilapia and shrimp operations face similar pressures, though with slight variations. Shrimp farming typically sees shrimp feed expenses ranging from 55-65% of costs, while tilapia sits comfortably in the 50-60% range. The pattern is clear—regardless of species, feed dominates operational budgets.

Why does feed hold such economic power? The answer lies in biology and scale. Fish and shrimp need consistent, nutritionally balanced meals to grow efficiently. Unlike terrestrial farming where animals can forage, aquaculture relies entirely on formulated feeds. When you’re raising millions of fish in controlled environments, those pellets become your largest recurring expense—period.

Aquaculture Feed Composition Vietnam: Key Ingredients and Formulations

Now let’s peek inside those feed bags to understand what Vietnamese farmers are actually buying. Aquaculture feed composition Vietnam follows scientifically developed formulas that balance nutrition with cost-efficiency.

Essential Components of Vietnamese Aquaculture Feed

For pangasius production, the recipe looks something like this:

Soybean meal forms the protein backbone, comprising 35-45% of feed formulations—often imported from Argentina where quality meets competitive pricing. This ingredient alone significantly influences the overall fish farming production costs.

Cereal products including rice bran and wheat contribute 25-30% of the mix. Vietnam’s abundant rice production provides a local advantage here, keeping costs somewhat controllable compared to imported alternatives.

Cassava or tapioca, sourced domestically from Vietnam’s cassava-growing regions, makes up 14-18% of feed. This starchy component provides energy and acts as a binding agent.

Fishmeal represents the variable ingredient, ranging from 2-7% depending on protein requirements. Higher protein feeds for juvenile stages need more fishmeal, directly impacting prices. This is where formulations get customized based on growth stages.

Vitamin, enzyme, and mineral supplements occupy a modest 2-3% but pack serious nutritional punch. These micronutrients ensure healthy growth and disease resistance.

Vegetable oil and amino acids round out the remaining 2-3%, supporting fat metabolism and protein synthesis.

Feed Formulation Variations by Species

The beauty—and complexity—of aquaculture feed composition Vietnam lies in its adaptability. Pangasius feeds differ markedly from shrimp or tilapia formulations. Higher protein requirements push fishmeal percentages upward, which directly escalates costs.

Vietnam enjoys a strategic advantage through regional ingredient sourcing. Domestic cassava, rice bran, and proximity to Asian commodity markets help moderate expenses. However, dependence on imported soybean meal and corn flour keeps Vietnamese producers vulnerable to global price swings.

Quality considerations matter enormously. Cheap feed might save money upfront but poor FCR and slower growth ultimately cost more. Smart farmers balance ingredient quality with nutritional outcomes rather than chasing the lowest price tag.

See more: Vietnam Seafood Export Boom 2025: Key Markets, Trends, and Opportunities for Importers

Fish Farming Production Costs: Breaking Down the Economics

Let’s get practical about where money flows in Vietnamese aquaculture operations. Understanding the complete cost structure helps contextualize why the feed cost impact dominates financial planning.

Cost Structure Analysis

In pangasius farming, that 60-70% feed allocation translates to real numbers. On a farm producing 100 tons annually, if total costs hit $150,000, roughly $90,000-$105,000 goes straight to feed purchases. That’s serious money.

Other operational expenses—labor, pond maintenance, water management, electricity for aerators, disease treatment, and infrastructure depreciation—split the remaining 30-40%. While significant, these costs remain relatively stable and predictable.

Feed conversion efficiency becomes the profit multiplier. A farm achieving 1.6 FCR versus 2.0 FCR saves substantial amounts on feed per kilogram of fish produced. That efficiency difference might represent the gap between profit and loss in tight market conditions.

Seasonal variations complicate planning. During peak growing seasons when water temperatures optimize growth, fish convert feed more efficiently. Cooler months see slower growth and marginally worse FCR, affecting fish farming production costs throughout the year.

Scale creates advantages. Larger operations negotiate better feed prices through volume purchasing, while small farms pay retail rates. This economy of scale partially explains industry consolidation trends.

Feed Cost Impact on Profit Margins

Vietnamese aquaculture operates on notoriously thin margins—often just 5-10% in competitive export markets. When global commodity prices spike, that slim buffer evaporates quickly.

Feed price fluctuations directly threaten farm viability. A 10% increase in feed costs might eliminate half the profit margin if farmers cannot pass increases to buyers—which they often can’t in contract-based export arrangements.

Price sensitivity runs deep. VNSeafoodInsider has watched farms suspend operations during periods of extreme feed cost spikes, waiting for conditions to improve. Others scramble to adjust formulations, sometimes compromising quality to maintain affordability.

Risk management strategies vary. Some farmers lock in feed prices through forward contracts. Others diversify into multiple species to spread risk. The savviest operations work closely with feed mills to optimize formulations for cost-efficiency without sacrificing growth performance.

See more: The Big Opportunity in Vietnam Seafood By-Product Pet Food

Global Commodity Prices and Shrimp Feed Expenses

What happens in Chicago trading pits matters in Mekong Delta fish ponds—that’s the interconnected reality of modern aquaculture. Recent global commodity prices movements illustrate this connection perfectly.

Recent Corn Price Movements and Their Impact

In late October 2025, corn prices surged on international markets, sending ripples through aquaculture feed composition Vietnam. Chicago Board of Trade December corn futures closed at $4.315 per bushel, marking a 1.95% increase and reaching the highest levels since July 2025.

Gulf Coast yellow corn #2 spot prices climbed even more dramatically to $5.145 per bushel—a 2.2% weekly jump. For Vietnamese feed mills importing American corn or corn-based products, these increases translate directly into higher manufacturing costs.

Why does corn matter so much? Beyond direct use in feed formulations, corn serves as a benchmark for cereal grain pricing globally. When corn rises, wheat and other grain alternatives tend to follow.

Drivers Behind Rising Feed Ingredient Costs

The October 2025 price surge stemmed from multiple factors converging simultaneously. Soybean price increases created spillover effects—as one major feed ingredient rises, related commodities often follow suit.

Optimism around US-China trade relations boosted agricultural commodity prices broadly. While trade discussions focused primarily on soybean purchases rather than corn or ethanol, positive sentiment lifted the entire sector.

Strong domestic demand within the United States maintained price support. Feed mills and ethanol plants restocked inventories as harvest season approached completion at approximately 80%. This steady buying prevented prices from softening despite abundant harvest volumes.

International Market Dynamics

Looking beyond American markets, FOB prices reflected global tightness. Argentina’s corn traded at $206 per ton, Brazil at $213 per ton, and Ukraine at $220 per ton—all showing modest increases from previous weeks.

Rabobank’s forecast added longer-term concern: Brazil’s 2025/26 corn production may decline 3.5% due to lower yields. As one of the world’s major corn exporters, Brazilian production shortfalls tighten global supplies and support higher prices.

For Vietnamese aquaculture, these international dynamics create unavoidable pressure. Whether sourcing from South America, North America, or Black Sea regions, shrimp feed expenses and fish feed costs face upward pressure throughout November 2025 and potentially beyond.

The outlook remains elevated. Analysts expect corn prices to hold current levels or drift higher through year-end, creating sustained headwinds for feed cost impact on aquaculture profitability.

See more: Top 20 biggest seafood companies in vietnam

Feed Cost Impact on Vietnamese Aquaculture Competitiveness

Vietnam’s position as the world’s leading pangasius exporter and a major shrimp producer means domestic cost structures directly influence international competitiveness. When fish farming production costs rise faster than competitors, market share hangs in the balance.

Pressure on Export-Oriented Production

Vietnamese pangasius competes globally against alternative whitefish products. If rising feed costs force price increases, importers might shift to substitutes like tilapia or wild-caught alternatives. The feed cost impact doesn’t stay contained on farms—it flows through to international trade dynamics.

Exchange rate movements add another layer. When the Vietnamese dong strengthens against importing currencies, dollar-denominated export prices effectively rise even if dong costs remain stable. Conversely, dong weakness provides a cushion against increasing local costs.

Competition from other producing nations—particularly those with different cost structures or government subsidies—intensifies pressure. Thai, Indonesian, and emerging African producers all eye Vietnam’s market position.

Adaptation Strategies in the Industry

Vietnamese aquaculture isn’t sitting idle while costs climb. Alternative ingredient research explores domestically abundant resources like insect meal, single-cell proteins, and plant-based alternatives to expensive fishmeal and imported soybean meal.

Feed efficiency improvements through genetics and management receive heavy investment. Selective breeding programs aim to develop pangasius and shrimp strains with superior feed conversion ratios, directly attacking the feed cost impact challenge.

Vertical integration models gain traction. Larger companies control feed production, farm operations, and processing—capturing margins across the value chain and insulating against price volatility at any single stage.

Contract farming arrangements provide price stability for both farmers and feed suppliers, creating predictability that helps manage the aquaculture feed composition Vietnam cost challenges.

Managing Feed Cost Impact: Strategies for Aquaculture Producers

VNSeafoodInsider believes Vietnamese aquaculture’s future depends on smart cost management rather than simply accepting rising expenses. Successful farmers increasingly focus on feed efficiency metrics, adopt improved genetics, diversify ingredient sources where possible, and build financial buffers during profitable periods.

The feed cost impact on Vietnamese fish and shrimp production represents both challenge and opportunity. Those who innovate around feed efficiency, embrace alternative ingredients, and optimize operations will thrive. Others may struggle as global commodity prices continue their volatile dance. In an industry where 60-70% of costs flow into feed, mastering this challenge isn’t optional—it’s essential for survival in competitive global markets. You’re witnessing an industry transformation, one feed pellet at a time.