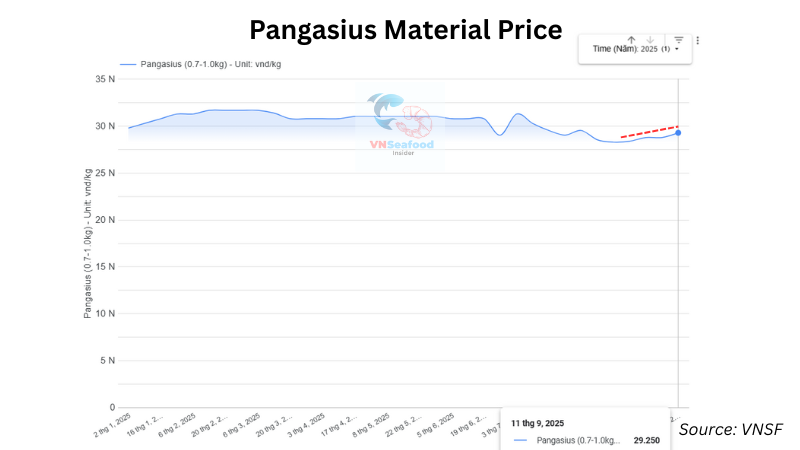

As we approach the final quarter of 2025, VNSeafoodInsider is seeing signals that pangasius export prices are likely poised for an upward trajectory. The convergence of supply constraints, seasonal demand patterns, and global whitefish market dynamics creates a perfect storm that’s reshaping the pricing landscape for Vietnam’s signature aquaculture product.

The pangasius industry, which has weathered its fair share of storms over the past few years, is experiencing what can only be described as a renaissance moment. With export values climbing and supply chains tightening, industry stakeholders are preparing for what could be the most significant price adjustment in recent memory.

Outline

ToggleCurrent Pangasius Export Price 2025 Performance Shows Strong Recovery

The numbers don’t lie – Vietnam’s pangasius export sector has demonstrated remarkable resilience throughout 2025. In the first eight months of the year, export values reached an impressive $1.4 billion, marking a robust 10% increase compared to the same period in 2024. This growth trajectory has been particularly pronounced in recent months, with August 2025 alone contributing $200 million in export value, representing a solid 5% growth compared to the previous year.

These figures tell a story of an industry that has not only survived its challenging period but has emerged stronger and more competitive. The consistent month-over-month growth indicates that international buyers are regaining confidence in Vietnamese pangasius, recognizing both its quality improvements and competitive pricing advantages in the global whitefish market.

What makes these numbers even more compelling is the context in which they’re occurring. The pangasius sector faced significant headwinds in previous years, including trade disputes, environmental concerns, and changing consumer preferences. The current recovery suggests that producers have successfully addressed many of these challenges while positioning themselves to capitalize on emerging market opportunities.

See more: Vietnam Seafood Export Statistics 2025: $6.2 Billion Revenue Shows 17% Growth in First 7 Months

Vietnam Pangasius Export Trends Indicate Supply Tightening

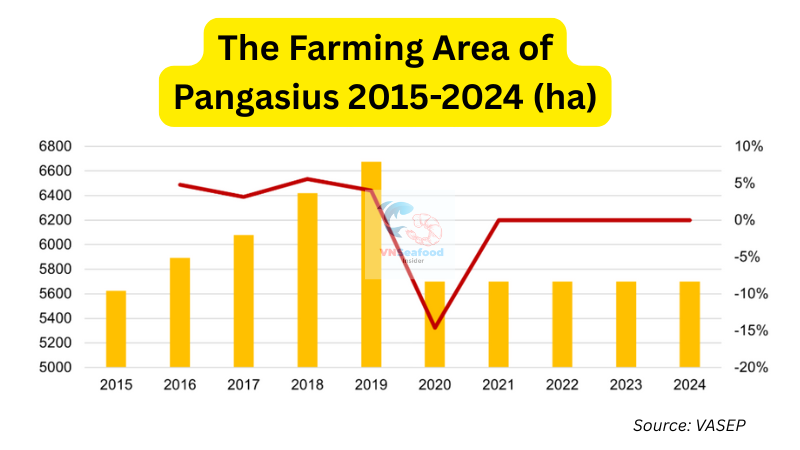

Here’s where things get really interesting for you as an industry observer or stakeholder. The supply side fundamentals are undergoing a dramatic shift that’s creating the foundation for higher pangasius export prices throughout the remainder of 2025.

The most telling indicator comes from the fingerling market, where prices have surged to VND 42,000-43,000 per kilogram for sizes ranging from 28-35 pieces per kilogram as of mid-September (source from VASEP). This represents a staggering 50% increase from August levels – a jump that would make any commodity trader take notice. When fingerling prices move this dramatically, it’s essentially the market’s way of signaling that something fundamental has changed in the supply equation.

But it’s not just about price – it’s about availability and quality. Industry sources report that survival rates for pangasius fingerlings have been disappointing this season, creating bottlenecks that will ripple through the supply chain for months to come. Lower survival rates mean fewer fish reaching marketable size, which inevitably translates to tighter supply and upward pressure on pangasius material prices.

Perhaps even more significant is the behavioral shift among farmers. Many are adopting a “wait and see” approach, holding onto their stock in anticipation of higher prices. This strategic holding pattern creates an additional layer of supply constraint, as fish that would normally enter the processing pipeline are being retained on farms.

See more: Top 20 biggest seafood companies in vietnam

Supply Chain Factors Driving Pangasius Export Price 2025 Increases Anticipation

The supply chain dynamics driving the anticipated pangasius export price 2025 likely increases are multifaceted and interconnected, creating a complex web of factors that industry participants need to understand and navigate.

Raw material scarcity has emerged as the primary driver of price pressure. The combination of reduced fingerling availability, lower survival rates, and strategic holding by farmers has created a supply squeeze that’s unprecedented in recent years. This isn’t just a temporary blip – it represents a fundamental shift in supply-demand dynamics that’s likely to persist well into 2026.

The breeding challenges facing the industry cannot be understated. Environmental factors, disease pressure, and genetic bottlenecks have all contributed to the current situation where producing healthy, viable fingerlings has become increasingly difficult and expensive. These challenges don’t resolve overnight, meaning the supply constraints we’re seeing now are likely to influence market dynamics for an extended period.

From a timeline perspective, industry analysts expect the price increases that began materializing in September to gain momentum as we progress through Q4. The lag time between fingerling production and market-ready fish means that the current supply constraints will take months to work through the system. By the time farmers who are holding stock decide to release their inventory, the seasonal demand surge for Q4 holiday stocking will likely absorb any additional supply without significantly impacting the upward price trajectory.

Regional supply distribution patterns are also playing a role. Traditional production centers in the Mekong Delta are experiencing varying degrees of supply constraint, with some provinces faring better than others. This geographic disparity in supply availability is creating opportunities for producers in less affected areas while putting additional pressure on those in regions experiencing more severe constraints.

The psychological aspect of farmer behavior cannot be ignored either. After years of relatively low prices, many producers view the current market dynamics as an opportunity to recover some of their previous losses. This mentality reinforces the holding pattern we’re observing and adds a speculative element to the supply equation.

See more: Inside Vietnam Pangasius Farming What Every Seafood Importer Must Know Before Buying

Whitefish Supply Shortage Creates Market Opportunity

The global whitefish market is experiencing its own set of supply challenges, and Vietnamese pangasius is uniquely positioned to benefit from these dynamics. Wild-caught species like pollock and cod, which traditionally dominate the whitefish category, are facing significant supply constraints due to environmental factors and fishing quota limitations. The cod quantity has been dropped 25% compared to last year.

This supply shortage in wild-caught alternatives has created a market opportunity that Vietnamese pangasius producers are well-positioned to exploit. Pangasius offers many of the same culinary characteristics as traditional whitefish species but at a more affordable price point, making it an attractive option for both foodservice operators and retail consumers looking for value.

The United States market, in particular, presents significant opportunities following the establishment of clear tariff parameters. With the 20% tariff rate now clearly defined, importers and distributors can make informed purchasing decisions without the uncertainty that previously plagued the market. This clarity has already begun to translate into increased order activity from US buyers.

The positioning of pangasius as an “affordable whitefish” is gaining traction in key markets, with buyers recognizing that the quality improvements achieved by Vietnamese producers over recent years make it a viable substitute for more expensive wild-caught alternatives. This market repositioning is supporting both volume growth and price improvement for Vietnamese exporters.

See more: Top 5 exotic vietnam white fish that the importers should consider

Q4 Seafood Market Forecast: Holiday Stocking Season Impact

As we enter the final quarter of 2025, seasonal demand patterns are converging with supply constraints to create what could be the most dynamic Q4 in recent memory for the pangasius export market. The fourth quarter traditionally represents a critical period for seafood exporters as buyers stock inventory in preparation for holiday seasons across key markets.

This year’s Q4 dynamics are particularly compelling because they’re occurring against a backdrop of constrained supply and improving market sentiment. Buyers who might typically spread their purchasing throughout the quarter may find themselves competing for limited available inventory, potentially driving prices higher than current projections suggest.

Market Outlook for Pangasius Export Price 2025

Looking ahead to the remainder of 2025, market indicators suggest several potential scenarios for pangasius export price 2025 trends. Current data points toward an anticipated upward trend, with potential increases of 10-15% above current levels by year-end, though market dynamics remain inherently unpredictable.

Supply-demand balance analysis indicates that existing constraints may persist through the first half of 2026, potentially supporting higher price levels. However, the actual pace and magnitude of price movements will depend on multiple variables including farmer behavior, weather conditions, and buyers’ ability to secure alternative supply sources.

For importers and distributors, current market signals suggest considering Q4 inventory planning carefully. The combination of seasonal demand and apparent supply constraints may influence availability and pricing as the quarter progresses, though market conditions can change rapidly.

Key risk factors to monitor include weather-related disruptions, regulatory changes in major markets, and potential shifts in farmer psychology that could affect supply releases.

Conclusion

The pangasius export price 2025 landscape presents a complex picture of recovery signals and market opportunities, though future outcomes remain uncertain. Current supply constraints, seasonal demand patterns, and global whitefish market dynamics appear to align in favor of price support through Q4, yet market volatility remains a constant factor.

For industry participants, staying informed about these evolving trends while maintaining flexible strategies will be essential. Whether optimizing market timing or planning inventory strategies, understanding these underlying market indicators—while recognizing their inherent uncertainty—may prove valuable for informed decision-making.

Final Disclaimer: This analysis represents current market observations and should not be considered as investment or trading advice. All business decisions should be made based on comprehensive due diligence and professional consultation.

Pingback: Phosphate Treatment in Fish Fillets: EU Standards, Moisture Limits, and Buyer Guide