The pangasius industry is living through a curious contradiction right now. Walk through any fish fry supplier in the Mekong Delta, and you’ll hear farmers grumbling about skyrocketing fingerling costs. Yet flip the page to raw material prices, and the story flatlines—stable, unmoved, almost stubbornly calm.

At VNSeafoodInsider, we’ve been tracking this unusual split closely. Welcome to the 2025 pangasius paradox: high input costs colliding with steady output prices. As Q4 unfolds, the Vietnam pangasius fish price landscape reveals both promise and pressure—a market gaining export traction while wrestling with internal pricing tensions that could shape strategies well into 2026.

Outline

ToggleThe Price Paradox – High Fry Prices vs. Stable Vietnam Pangasius Fish Price for Raw Material

Let’s start where it gets weird. If you’re in the business, you’ve probably felt the squeeze at both ends—but not equally.

Surging Fry Prices Across the Mekong Delta

Pangasius fry prices have shot up like a rocket this year. In provinces like Dong Thap, Long An, Tien Giang, and Can Tho, pangasius fingerlings (size 30 pcs/kg) are now trading at 55,000–65,000 VND/kg. That’s more than double what they cost at the start of 2025, when you could snag them for a modest 25,000–28,000 VND/kg.

What’s driving this surge? Two main culprits:

- Tightened fry supply: Hatcheries scaled back production earlier in the year due to uncertainty. Now that stocking demand is roaring back, supply can’t keep up.

- Increased stocking demand: Farmers are betting on a better second half. With export orders picking up and processors signaling cautiously positive outlooks, ponds are filling fast.

The irony? This enthusiasm at the pond level hasn’t translated into higher prices for the fish themselves.

Why Vietnam Pangasius Fish Price for Raw Material Remains Stable

Here’s where the paradox deepens. Despite fry costs doubling, the Vietnam pangasius fish price for raw material hovers stubbornly around 29,500–32,000 VND/kg for the standard 800–1,100g size. Larger fish—those over 1.3kg—have even dipped slightly, shedding a few hundred dong per kilo in November.

So why the disconnect?

First, the pangasius raw material price already climbed earlier in 2025. Processors absorbed those increases and locked in contracts. Further hikes now would risk losing competitiveness in price-sensitive export markets like the U.S. and EU.

Second, there’s market resistance. Buyers abroad are watching their own inflation woes and inventory levels. Pushing prices higher could mean fewer orders—a gamble processors aren’t eager to take.

Finally, exporters are balancing their books. They’re managing costs internally, squeezing margins where they can, and avoiding sudden moves that might spook customers or create supply chain hiccups heading into 2026.

Impact of the Paradox on Farmers and Processors

This pricing mismatch isn’t just a curiosity—it’s a real headache for the people in the trenches.

Farmers are feeling margin pressure. Paying twice as much for fry while selling fish at stable prices means thinner profits. Some are delaying stocking decisions or reducing pond density to manage risk.

Processors, meanwhile, are walking a tightrope. They need steady raw supply to meet growing export orders, but they can’t afford to overpay and wreck their own margins. The result? Conservative buying strategies and careful planning for early 2026, when today’s fry will mature into harvest-ready fish.

Vietnam Pangasius Fish Price and Export Performance January–October 2025

Now let’s zoom out and look at the bigger picture. Because while prices tell one story, export numbers tell another—and it’s a more optimistic one.

Total Export Value Reaches USD 1.8 Billion (+9%)

Vietnam’s pangasius export value for the first ten months of 2025 hit USD 1.8 billion, up 9% compared to the same period in 2024. Not a moonshot, but solid growth in a year marked by global economic uncertainty.

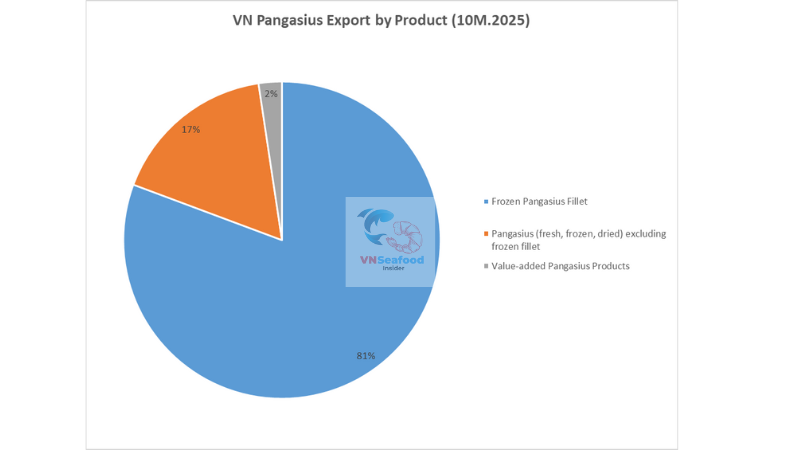

Performance by Product Category

Breaking it down by product type reveals where the action really is:

- Fresh, frozen, and dried pangasius (HS 03 excluding 0304): USD 315 million, up a marginal 0.1%. Basically flat—demand for whole fish or basic frozen products is steady but unspectacular.

- Pangasius fillet (HS 0304): USD 1.5 billion, up 11%. This is the star of the show. Fillet products—skinless, boneless, ready to cook—continue to drive the pangasius export market 2025 forward.

- Value-added products (HS 16): USD 44 million, up 19%. Small in absolute terms, but the fastest-growing segment. Think breaded fillets, marinated portions, ready-to-eat items. These command higher prices and better margins.

Why Fillet Products Drove Vietnam Pangasius Fish Price Stability

Here’s the thing: fillet demand favors the 800–1,100g size range—exactly the size that’s keeping raw material prices stable. Processors know this sweet spot sells well in China, the EU, and CPTPP markets. So they’re focused on sourcing fish in this range, which creates consistent buying pressure and price stability.

Meanwhile, Vietnamese pangasius has shifted toward higher-value markets where quality and processing matter more than rock-bottom prices. This strategic pivot helps maintain competitiveness even when raw costs inch upward.

See more: Inside Vietnam Pangasius Farming What Every Seafood Importer Must Know Before Buying

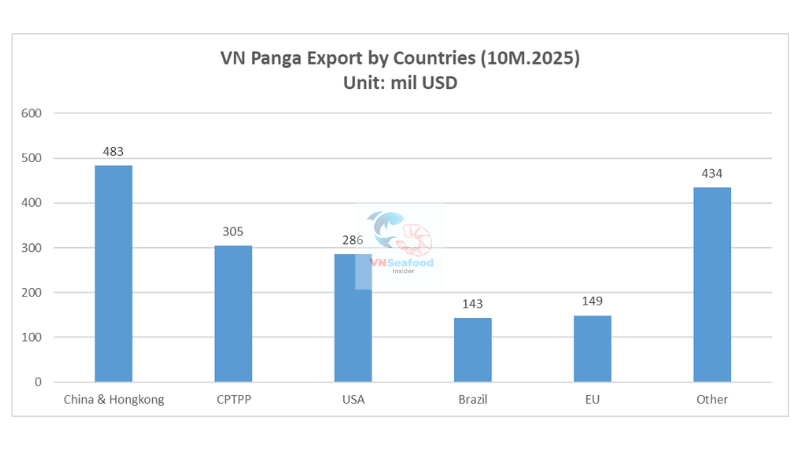

Key Export Markets Influencing Vietnam Pangasius Fish Price in Early Q4 2025

Export markets don’t just buy the fish—they shape its price. Let’s tour the big four and see who’s moving the needle.

China & Hong Kong – Strong Recovery in October

China (including Hong Kong) remains the top destination, with USD 483 million in export value through October, up 1% year-on-year. That might sound modest, but October alone delivered USD 73 million—a 19% jump compared to October 2024.

After a September slowdown, this rebound signals renewed appetite heading into China’s year-end consumption season. For farmers and processors, it’s a confidence booster. Strong Chinese demand supports Vietnam pangasius fish price stability and justifies cautious optimism about Q4 orders.

United States – Decline Despite Stable Vietnam Pangasius Fish Price

The U.S. paints a tougher picture. Ten-month export value sits at USD 286 million, down roughly 25%. October alone brought in just USD 29 million, down 17% year-on-year.

What’s going wrong?

- Inventory overhang: U.S. importers stocked up heavily in 2023–2024. They’re still working through that inventory.

- Trade policy headwinds: Anti-dumping reviews, tariff uncertainties, and tighter inspection protocols add friction and cost.

- Competition: Tilapia, cod, and domestic catfish are all vying for the same freezer space and restaurant menus.

Despite stable pangasius prices from Vietnam, buyers aren’t biting—literally. The silver lining? Most analysts expect a U.S. rebound in Q1 2026 once inventories normalize.

Brazil – A Bright Spot with Fast Growth

Brazil is quietly becoming a pangasius powerhouse. With USD 143 million in ten-month export value, Brazil’s up 38% compared to last year. October hit USD 15 million, a modest 1% increase, but that came after a September dip—so the trend is still upward.

Brazilian consumers have embraced Vietnamese pangasius as an affordable, versatile whitefish. As local purchasing power grows, so does demand for imported protein. For Vietnamese exporters, Brazil is a diversification dream—fast-growing, less politically volatile, and hungry for fillet products.

European Union – Stabilizing Slowly

The EU delivered USD 149 million through October, up 3%. It’s not explosive growth, but it’s steady—and after years of inflation and energy shocks, steady is good.

Some EU markets are recovering faster than others. Germany and the Netherlands show cautious optimism, while the UK lags (more on that shortly). Demand for frozen pangasius fillet remains solid, especially in foodservice and retail frozen sections.

Lingering inflation still pressures household budgets, so price sensitivity remains high. But as costs stabilize, EU buyers are dipping back into the market.

See more: Pangasius Quality Control – How to Avoid Quality Issues When Importing Pangasius

CPTPP Markets Boosting Pangasius Export Market 2025

Here’s a subplot worth celebrating: CPTPP markets are punching above their weight.

CPTPP Contributes 17% of Total Pangasius Export Value

Exports to CPTPP member countries reached USD 305 million in the first ten months, up a whopping 36% year-on-year. That’s 17% of Vietnam’s total pangasius export value—a significant and growing slice.

Performance by Country

- Mexico: USD 63 million, up 1%. Growth has plateaued a bit, but Mexico remains a reliable buyer.

- Japan: USD 39 million, up 14%. Japanese consumers appreciate Vietnamese quality, and demand for value-added items is rising.

- Malaysia: Up 37%—the CPTPP standout. Malaysian foodservice and retail are embracing pangasius, and tariff advantages sweeten the deal.

Why CPTPP Markets Support Vietnam Pangasius Fish Price Stability

CPTPP markets offer a low-tariff environment, making Vietnamese products more competitive. They also show high acceptance of Vietnamese pangasius fillet quality and a growing appetite for value-added products.

This diversification cushions Vietnam against downturns in traditional markets like the U.S. and helps stabilize the Vietnam pangasius fish price by spreading demand risk across more geographies.

Market Sentiment Early Q4 2025 – Positive Signals but Mixed Challenges

So where does all this leave us as we head deeper into Q4?

Recovery in China, CPTPP Boost Momentum

There’s cautious optimism in the air. Chinese orders are climbing as the Christmas and Lunar New Year seasons approach. Faster customs clearance in China also helps keep shipments flowing smoothly.

CPTPP markets continue their steady march upward, providing a reliable backbone for exporters.

Headwinds in the U.S. and U.K. Affect Vietnam Pangasius Fish Price Upside

But it’s not all roses. The U.S. remains sluggish, and the UK is worse—October imports from Vietnam totaled just USD 4 million, down 33% year-on-year. Inventory overhang and weak consumer demand are limiting any upward pressure on pangasius prices.

Processors Maintain Conservative Raw Material Buying Strategy

Given the mixed signals, processors are playing it safe. They’re avoiding overstocking, watching foreign exchange fluctuations closely, and keeping an eye on competition from tilapia and cod.

This cautious stance helps explain why Vietnam pangasius fish price for raw material remains stable—no one wants to spark a price war or get caught holding expensive inventory if demand softens.

See more: The Big Opportunity in Vietnam Seafood By-Product Pet Food

Forecast – What’s Next for Vietnam Pangasius Fish Price in Late Q4 2025?

Let’s peer into the crystal ball—carefully.

Short-Term Price Outlook (Nov–Dec 2025)

Expect raw material prices to hold steady at 29,500–32,000 VND/kg through year-end. Processors have little incentive to push higher, and farmers are reluctant to sell at discounts given high fry costs.

Fry prices, however, will likely stay elevated. Farmers are stocking ponds for early 2026 harvest, keeping demand—and prices—high.

Export Outlook

- China: Demand continues rising through the holiday season. Watch for strong Q4 numbers.

- U.S.: Rebound unlikely until Q1 2026, once inventory clears.

- EU and CPTPP: Gradual recovery continues. No fireworks, but steady progress.

Factors That Could Push Prices Up or Down

Upside triggers:

- Strong holiday season orders exceeding expectations

- Reduced pond harvest volume due to disease or weather

Downside risks:

- Persistent U.S. and U.K. demand weakness

- Farmers over-stocking ponds, flooding the market with raw material in early 2026

Conclusion – Vietnam Pangasius Fish Price Holds Firm as Export Market Gains Traction

So there you have it—the 2025 pangasius paradox in full color. Vietnam pangasius fish price for raw material stays stable even as fry costs soar, creating tension but also opportunity. Export growth is building a solid foundation for 2026, driven by China’s recovery, Brazil’s surge, and CPTPP’s steady rise.

The key lesson for you? Diversification matters. Relying on one or two markets is risky. Spreading exposure across China, CPTPP, Brazil, and the EU helps cushion shocks and stabilize pricing.

At VNSeafoodInsider, we’ll keep watching the numbers, the trends, and the stories behind them. Because in this industry, understanding the paradox isn’t just interesting—it’s profitable.