The global seafood industry is witnessing remarkable shifts, and Vietnam continues to emerge as a powerhouse supplier. With Vietnam seafood export figures showing unprecedented growth through the first five months of 2025, international buyers are taking notice. Whether you’re a seasoned importer or exploring new supply partnerships, the latest data reveals compelling opportunities and strategic insights that could reshape your sourcing decisions.

At VNSeafoodInsider, we’ve analyzed the comprehensive export statistics to bring you the most actionable intelligence for your business planning. The numbers tell a story of resilience, strategic adaptation, and market dynamics that every global importer should understand.

Outline

ToggleVietnam Seafood Export Performance: Record-Breaking First Five Months

The Vietnam seafood export sector has delivered exceptional performance in early 2025, defying many industry predictions and showcasing the country’s adaptability in challenging market conditions. The headline numbers are impressive, but the underlying trends reveal even more compelling insights for strategic decision-making.

According to VASEP data, total export value reached an astounding $4.346 billion during the January-May period, representing a robust 22.3% year-over-year growth. This performance significantly outpaced most industry forecasts and demonstrates Vietnam’s strengthening position in global seafood supply chains.

May 2025 alone contributed $997 million to this total, marking a 20.3% growth compared to May 2024. This monthly figure represents the strongest performance of the year so far and indicates accelerating momentum rather than seasonal fluctuations.

The growth surge isn’t coincidental. Vietnamese exporters have strategically responded to US tariff policy changes, capitalizing on a temporary “window of opportunity” created by reduced duty rates. From April 9 to July 9, 2025, the US implemented a temporary 10% tariff on Vietnamese imports, dramatically lower than the anticipated 46% rate that had been looming over the industry.

This tactical advantage prompted Vietnamese suppliers to accelerate shipments and fulfill pending orders, creating the exceptional growth figures we’re seeing. However, as we’ll explore later, this presents both opportunities and risks for long-term supply chain planning.

Vietnam Seafood Export by Product Categories: Comprehensive Breakdown

Understanding the product mix driving Vietnam seafood export growth is crucial for importers seeking specific categories or diversification opportunities. The performance varies significantly across species, revealing distinct market dynamics and supply chain strengths.

Shrimp Exports Lead Vietnam Seafood Export Growth

Vietnamese shrimp supplier networks have demonstrated exceptional performance, cementing Vietnam’s position as a premier shrimp source for global markets. The category achieved $1.715 billion in export value during the five-month period, representing an impressive 32.3% increase over the same period in 2024.

May 2025 proved particularly strong for shrimp exports, reaching $415.3 million – the highest monthly figure recorded in 2025. This performance reflects not only seasonal demand patterns but also successful market positioning by Vietnamese producers who have invested heavily in quality improvements and sustainable farming practices.

The shrimp category’s outperformance stems from several factors. Vietnamese shrimp suppliers have successfully upgraded their processing facilities, improved traceability systems, and developed specialized products for different market segments. Whether you’re sourcing frozen raw shrimp, cooked products, or value-added preparations, Vietnamese suppliers have demonstrated consistent quality and competitive pricing.

For importers, this growth trajectory suggests reliable supply availability and potential for strategic partnerships. The 32.3% growth rate indicates expanding production capacity and strong farmer engagement, suggesting sustainability in supply chains.

See more: Global Shrimp Market Trends 2025

Pangasius (Tra Fish) Recovery Strengthens Vietnam Seafood Export Portfolio

The pangasius fish importer community has witnessed a remarkable turnaround story in Vietnamese tra fish exports. After facing significant challenges in previous years, particularly in the US market, pangasius exports have shown clear signs of recovery and stabilization.

Five-month totals reached $828.8 million, representing 11% growth compared to the same period in 2024. While this growth rate appears modest compared to shrimp, the trajectory tells a more encouraging story when examined monthly.

April 2025 showed only 3.8% growth, suggesting cautious market conditions. However, May exploded with 12.9% growth, indicating successful market re-entry strategies and renewed buyer confidence. This acceleration demonstrates the resilience of Vietnamese pangasius producers and their ability to adapt to changing market conditions.

The recovery from US market challenges has been particularly notable. Vietnam seafood export data shows pangasius shipments to the US, which had declined sharply in April, recovered to 35% growth in May. This dramatic turnaround reflects strategic timing of shipments to take advantage of the temporary tariff reduction period.

For importers, this recovery presents compelling value opportunities. Pangasius offers excellent protein value, consistent quality, and versatile application across foodservice and retail channels. Vietnamese producers have used the challenging period to improve product development and customer service, making them stronger partners moving forward.

See more: Inside Vietnam Pangasius Farming What Every Seafood Importer Must Know Before Buying

Tuna and Other Species Supporting Vietnam Seafood Export Diversification

Product diversification continues strengthening Vietnam’s export portfolio beyond the traditional shrimp and pangasius categories. These “other” categories increasingly contribute to overall Vietnam seafood export performance and offer importers additional sourcing opportunities.

Vietnam Tuna exports reached $405.3 million with 4.9% growth during the five-month period. While growth appeared modest, monthly trends showed improvement, with May achieving 7.6% growth after April’s slight decline. Vietnamese tuna processors have focused on premium product development and sustainable sourcing practices, appealing to quality-conscious importers.

Other fish species delivered exceptional performance with $873.3 million in exports and remarkable 20.8% growth. This category includes various marine and freshwater species, reflecting Vietnam’s diverse aquaculture and fishing capabilities. The strong performance indicates successful market development efforts and growing international recognition of Vietnamese seafood quality beyond traditional products.

Squid and octopus exports contributed $273.9 million with 14.5% growth, demonstrating steady demand for Vietnamese cephalopod products. Processing improvements and quality consistency have helped Vietnamese suppliers gain market share in competitive international markets.

Perhaps most impressive was the crab and other crustaceans category, achieving $143.9 million in exports with spectacular 48.3% growth. This performance reflects successful premium product positioning and growing demand for specialty Vietnamese seafood products.

Vietnam Seafood Export Market Analysis: Key Destinations for Importers

Geographic distribution of Vietnam seafood export reveals important market dynamics and partnership opportunities for importers worldwide. Understanding these patterns helps optimize sourcing strategies and identify emerging opportunities.

US Market Drives Vietnam Seafood Export Surge

The United States has emerged as the primary driver of Vietnam seafood export growth in 2025, though this surge comes with important caveats that importers must understand for strategic planning.

May 2025 exports to the US reached $234 million, representing extraordinary 61% growth compared to May 2024. This growth rate far exceeded performance in other major markets and directly reflects the strategic response to temporary tariff advantages.

Five-month totals to the US market reached $774 million with 27% growth, making America Vietnam’s most dynamic export destination. However, this exceptional performance is largely driven by the temporary 10% tariff rate versus the expected 46% rate that may return after July 9, 2025.

The surge represents both opportunity and risk for US importers. Those able to establish supply relationships during this period may benefit from competitive pricing and strong service levels as Vietnamese suppliers work to build long-term partnerships. However, the potential return to higher tariff rates creates uncertainty for sustained growth.

Seafood import statistics show that Vietnamese suppliers have used this period to demonstrate quality and reliability, potentially positioning themselves favorably even if tariff conditions change. Smart importers are evaluating not just current pricing but long-term partnership potential with Vietnamese suppliers who prove their capabilities during this critical period.

China and Hong Kong: Stable Growth Markets for Vietnam Seafood Export

The Greater China market continues providing stable, consistent growth for Vietnam seafood export, offering an important counterbalance to the volatility in US trade relationships. Combined China and Hong Kong markets achieved impressive 50% growth rates, demonstrating sustained demand and strong commercial relationships.

Shrimp exports to China specifically showed remarkable 90% growth, indicating both market appetite and Vietnamese suppliers’ success in meeting Chinese quality standards and preferences. This performance suggests strong potential for importers serving Asian markets or those considering market diversification strategies.

Shell-on products achieved extraordinary 285% growth in these markets, reflecting consumer preferences and Vietnamese suppliers’ ability to adapt product offerings to specific market demands. This specialization demonstrates the sophistication of Vietnamese export operations and their market responsiveness.

For importers, the China-Hong Kong market performance indicates several strategic advantages: stable demand patterns, growing consumer acceptance of Vietnamese products, and established logistics networks that support consistent supply chains.

EU and Japan: Consistent Vietnam Seafood Export Partners

European Union and Japanese markets continue demonstrating the steady, sustainable growth that makes them attractive long-term partners for Vietnam seafood export development. These markets offer stability and premium pricing potential that balances more volatile markets elsewhere.

The EU market achieved 14% steady growth, reflecting consistent demand and established supply relationships. European importers value Vietnamese suppliers’ investment in sustainability certifications, traceability systems, and quality standards that meet stringent EU requirements.

Japan showed 18% growth, indicating strong market acceptance and Vietnamese suppliers’ success in meeting Japanese quality expectations. The Japanese market particularly values consistent quality and reliable delivery schedules, areas where Vietnamese suppliers have demonstrated continuous improvement.

These markets represent reliable partnership opportunities for importers seeking stable supply relationships with predictable growth patterns. The premium pricing potential in EU and Japanese markets also provides Vietnamese suppliers with sustainable business models that support long-term capacity investments.

Anti-Dumping Tariff Update: Impact on Vietnam Seafood Export to US

Recent developments in US anti-dumping policies significantly impact Vietnam seafood export prospects, particularly for pangasius importers. Understanding these regulatory changes is crucial for supply chain planning and risk management.

Zero-Tariff Status for Leading Vietnamese Pangasius Exporters

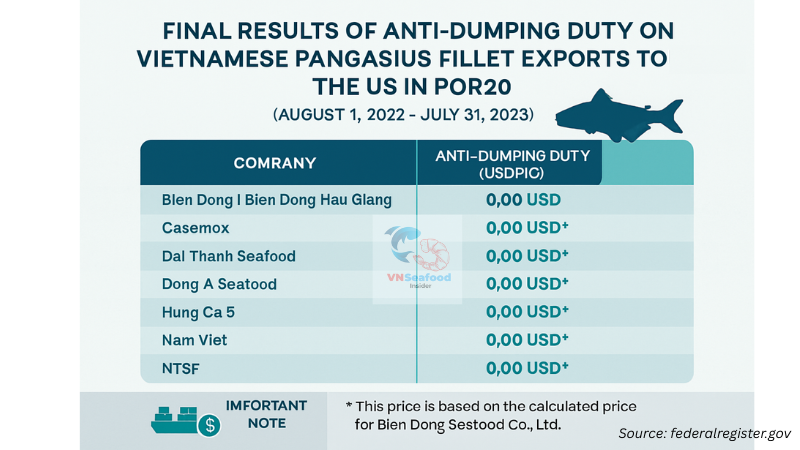

On June 18, 2025, the US Department of Commerce (DOC) announced official results for the 20th Periodic Administrative Review (POR20) covering frozen pangasius fillets imported from Vietnam. The review period covered August 1, 2022, through July 31, 2023, and delivered favorable results for several Vietnamese exporters.

Seven companies achieved 0% anti-dumping duties, representing a significant competitive advantage for both the suppliers and their importing partners. This zero-tariff status provides cost advantages and supply chain stability that smart importers can leverage for competitive positioning.

The qualifying companies include: Bien Dong Seafood/Bien Dong Hau Giang Seafood, Can Tho Import Export Seafood JSC (CASEAMEX), Dai Thanh Seafood Co. Ltd., Dong A Seafood LLC, Hung Ca 6 JSC, Nam Viet Corporation (NAVICO), and NTSF Seafood .

The DOC determination found that Bien Dong Seafood did not sell frozen pangasius fillets below normal value during the review period. The other six companies successfully demonstrated qualification for separate rates and received the same 0.00 USD/kilogram rate applied to Bien Dong.

For pangasius fish importer operations, these results create clear supply chain advantages. Partnering with zero-tariff suppliers provides cost predictability and competitive advantages in price-sensitive markets. The regulatory clarity also supports long-term contract negotiations and supply planning.

See more: Pangasius Quality Control – How to Avoid Quality Issues When Importing Pangasius

Vietnam Seafood Export Outlook: Opportunities and Challenges for Importers

Looking ahead, Vietnam seafood export prospects depend heavily on evolving trade policies and market dynamics. Understanding these factors helps importers make informed decisions about supply chain investments and partnership strategies.

Short-term Vietnam Seafood Export Projections

The immediate outlook for Vietnam seafood export hinges critically on US tariff decisions following July 9, 2025. Two distinct scenarios are emerging, each with significant implications for global supply chains and importing strategies.

If the 10% tariff rate continues or tariffs are eliminated entirely, Vietnam could maintain or exceed the $10 billion annual export target. This scenario supports continued investment in Vietnamese supply relationships and expansion of product categories.

However, if tariffs return to the anticipated 46% level, total annual exports could decline to approximately $9 billion, with significant risks extending into subsequent quarters. This scenario would likely force many Vietnamese suppliers to reduce US market focus and potentially redirect capacity to other markets.

Third-quarter 2025 presents particular risks if high tariffs are implemented. Many Vietnamese exporters may be forced to halt US shipments, creating supply disruptions and potential inventory challenges for US importers who haven’t diversified their supplier base.

Seafood import statistics suggest that the current surge represents accelerated shipments rather than expanded production capacity, meaning a sharp correction is possible if trade conditions deteriorate. Smart importers are planning for both scenarios and developing contingency strategies.

See full article: 3 Tariff Response Scenarios Post-July 9th Critical Impact on Vietnam Seafood Industry

Supply Chain Considerations for Vietnam Seafood Export Partners

The evolving trade landscape is attracting attention from competing suppliers who view potential Vietnamese market disruption as opportunity. Latin American suppliers, particularly from Brazil and Chile, are positioning themselves to capture market share if Vietnamese suppliers face sustained tariff disadvantages.

Regional alternatives from Thailand, India, and China are also adapting their strategies to potentially benefit from any Vietnamese supply chain disruptions. These competitive dynamics create both risks and opportunities for importers depending on their diversification strategies.

For importers committed to Vietnamese supply relationships, this environment emphasizes the importance of working with financially strong, adaptable suppliers who can navigate changing trade conditions. The suppliers achieving zero anti-dumping status, for example, demonstrate the regulatory compliance and operational excellence that supports sustained partnerships.

Long-term partnership strategies should emphasize supplier financial stability, production flexibility, and market diversification capabilities. Vietnamese suppliers with strong non-US market development are better positioned to maintain operations regardless of US trade policy changes.

See more: Top 20 biggest seafood companies in vietnam

Key Takeaways for Global Seafood Importers

The current Vietnam seafood export landscape presents both exceptional opportunities and notable risks that require careful evaluation and strategic planning.

Why Vietnam Seafood Export Remains Attractive

Despite trade uncertainties, Vietnam continues offering compelling advantages for seafood importers. Competitive pricing remains a key strength, supported by efficient production systems and favorable cost structures that provide value even in challenging trade environments.

Quality standards have improved consistently across Vietnamese suppliers, with many achieving international certifications and implementing advanced traceability systems. This quality improvement trend supports premium market positioning and reduces quality-related supply chain risks.

Vietnam frozen seafood production capacity continues expanding, supported by both aquaculture development and processing facility investments. This capacity growth suggests ability to meet increasing global demand and support supply chain scaling for growing importers.

Product portfolio diversity offers importers one-stop sourcing opportunities across multiple species and product formats. From basic frozen products to value-added preparations, Vietnamese suppliers increasingly offer comprehensive product ranges that simplify supply chain management.

Strategic Recommendations for Vietnam Seafood Export Partners

Successful partnership with Vietnamese suppliers requires strategic approaches that account for both current opportunities and potential challenges. Diversification across multiple Vietnamese suppliers reduces concentration risk and provides supply security if individual suppliers face difficulties.

Understanding the tariff landscape and its implications helps optimize timing of orders and inventory management. Importers who grasp these dynamics can potentially benefit from pricing opportunities while avoiding supply disruptions.

Building resilient supply chain relationships emphasizes long-term partnership development over short-term cost optimization. Vietnamese suppliers investing in sustainability, quality improvement, and market diversification offer better partnership prospects than those focused solely on current price competition.

Regular communication and market intelligence sharing strengthens supplier relationships and provides early warning of potential disruptions. Vietnamese suppliers value partners who understand their challenges and work collaboratively on solutions.

The Vietnam seafood export story of 2025 demonstrates both the opportunities and complexities of modern global supply chains. While current growth rates are impressive, sustainable success requires strategic thinking and careful partnership development.

At VNSeafoodInsider, we believe the key to success lies in understanding both the numbers and the stories behind them. Vietnamese suppliers who are investing in quality, sustainability, and market diversification offer the best long-term partnership potential, regardless of short-term trade policy fluctuations.

Whether you’re exploring Vietnamese supply relationships for the first time or optimizing existing partnerships, the current market dynamics create unique opportunities for strategic importers who understand the landscape and act thoughtfully.

Ready to connect with verified Vietnamese seafood suppliers? Our network of pre-qualified exporters can help you navigate current opportunities while building resilient supply chain relationships for long-term success.

Subscribe for monthly Vietnam seafood export updates and stay ahead of market developments that impact your sourcing strategies.

Pingback: Vietnam Seafood Exports Tariff Set at 20% After Trump Deal