Picture this: You’re sipping your morning coffee, scrolling through seafood market reports, when a number jumps out at you—$2.5 billion. That’s how much Vietnam shrimp exports were in just seven months of 2025. Pretty impressive, right?

Here at VNSeafoodInsider, we’ve been tracking this remarkable journey, and frankly, we’re amazed by what we’re seeing. The Vietnam shrimp export story isn’t just about numbers—it’s about smart positioning, perfect timing, and two massive markets that are practically throwing money at Vietnamese suppliers. If you’re an importer or distributor, you’ll want to pay attention to what’s happening in China and the US markets.

Outline

ToggleVietnam Shrimp Export Performance Overview (2025 Results)

Let’s start with the elephant in the room—or should we say, the shrimp in the ocean? Vietnam’s performance this year has been nothing short of spectacular.

Vietnam shrimp export hit $2.5 billion in the first seven months of 2025. But here’s the kicker: May alone brought in $415.3 million, the highest monthly figure we’ve ever recorded. It’s like watching a perfectly executed business plan unfold in real-time.

What makes this even more impressive? Vietnam now sits comfortably as the world’s fourth-largest shrimp exporter. We’re talking about competing with giants like Ecuador, China, and India—and holding our ground beautifully.

The secret sauce? Vietnamese exporters have cracked the code on balancing volume with value. Instead of racing to the bottom on price, they’ve climbed toward the premium end. Smart move, considering what’s happening in the two biggest markets.

See more: How to Source High Quality Shrimp from Vietnamese Shrimp Suppliers

China Emerges as Vietnam’s Largest Shrimp Market

Now, here’s where things get really interesting. If you’ve been sleeping on the China opportunity, it’s time to wake up.

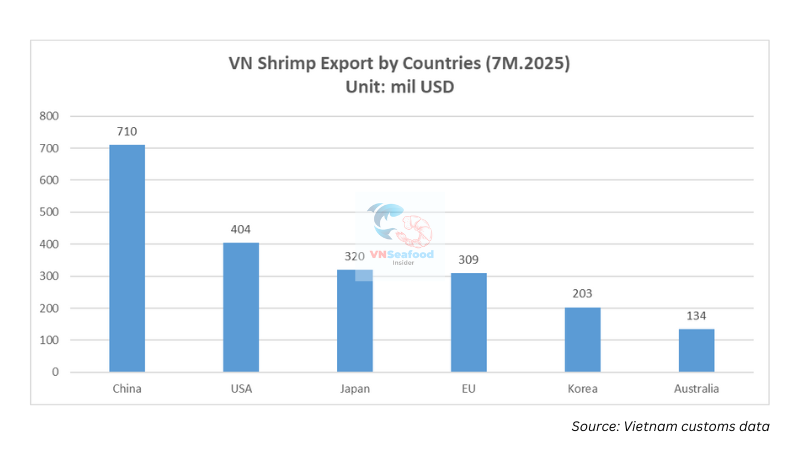

China has become Vietnam’s shrimp export goldmine, importing $710 million worth in seven months—that’s a jaw-dropping 78% growth. Compare that to the US market’s modest 3% bump to $404 million, and you can see where the momentum is building.

But let’s dig deeper into what makes the China shrimp import market so fascinating. Chinese consumers aren’t just buying any shrimp—they want the good stuff. We’re talking live lobsters, monster-sized tiger shrimp (tôm sú), and premium frozen varieties that make your wallet sing.

Here’s a fun fact that’ll surprise you: while basic white-leg shrimp exports to China actually dropped, the fancy stuff—premium varieties—shot up with triple-digit growth. Chinese diners have developed quite the taste for luxury, and Vietnamese suppliers are more than happy to oblige.

The competitive landscape tells an interesting story too. Ecuador dominates with sheer volume (75% market share, about 389,000 tons), but they’re playing the quantity game. India, traditionally strong, has stumbled to just 76,000 tons due to quality headaches and trying to serve too many masters at once.

Vietnam? We’ve chosen the road less traveled—premium positioning. Instead of fighting Ecuador on volume or India on price, Vietnamese seafood export companies have carved out the high-end niche. It’s like being the boutique wine seller in a market full of discount liquor stores.

US Shrimp Market Opportunities for Vietnamese Exporters

The US market might seem less exciting with its 3% growth, but trust us—there’s gold in them hills, especially if you know where to look.

Here’s where it gets juicy: Vietnam’s main competitors in the US are shooting themselves in the foot. India faces brutal 50% tariffs that make their shrimp about as attractive as week-old sushi. Meanwhile, Indonesia is dealing with 19% tariffs AND—brace yourself—radiation contamination issues that have the FDA pulling products off shelves faster than you can say “quality control nightmare.”

For Vietnamese exporters, this is like watching your competition trip over their own shoelaces while you cruise past them. Vietnam’s clean regulatory record and FDA compliance track record suddenly look very, very valuable.

The numbers back this up. While shell-on shrimp saw modest growth, Vietnamese peeled shrimp exports jumped 21% in the US market. That’s not just beating the competition—that’s lapping them (competitors managed a measly 2% growth).

What makes the US shrimp market particularly attractive for Vietnam is the American obsession with traceability and food safety. You know how Americans love their documentation and certifications? Vietnamese suppliers have embraced this completely, turning bureaucratic requirements into competitive advantages.

See more: Top 5 shrimp processing companies in Vietnam

Strategic Market Positioning for Vietnamese Seafood Export Success

Let’s talk about strategy for a moment. Vietnam’s approach to global markets reminds us of a chess grandmaster—always thinking several moves ahead.

The beauty of Vietnam’s export strategy lies in its diversification. Sure, China and the US grab headlines, but look at the supporting cast: Japan ($320 million), EU ($309 million), South Korea ($203 million), and Australia ($134 million). It’s like having multiple income streams—if one market sneezes, you don’t catch pneumonia.

Vietnamese seafood export success comes down to one word: quality. While competitors chase volume, Vietnamese processors have invested in facilities that would make a Swiss watchmaker jealous. Modern equipment, bulletproof cold chains, and certification programs that check every box imaginable.

This isn’t just about meeting standards—it’s about exceeding them so consistently that buyers start viewing Vietnamese suppliers as premium partners rather than just vendors. That’s the difference between competing on price and competing on value.

See more: Vietnam Seafood Export Statistics 2025

Future Outlook and Import Opportunities

So, where does this leave you as an importer or distributor? In a pretty sweet spot, actually.

Vietnam shrimp export is targeting $4 billion annually by 2025, and honestly, we think they’ll hit it. The infrastructure investments are paying off, consumer trends favor premium products, and the competitive landscape keeps getting more favorable for Vietnamese suppliers.

Here’s our take: if you’re sourcing shrimp and haven’t established strong Vietnamese partnerships yet, you’re missing out on one of the most reliable, quality-focused supply bases in the world. The numbers don’t lie—Vietnamese suppliers are delivering consistent growth, premium products, and supply chain reliability that’s becoming increasingly rare in today’s market.

The opportunity is clear. Vietnam has positioned itself perfectly between the volume players and ultra-premium specialists. They offer the quality you need, the reliability you crave, and the growth trajectory that makes business partnerships truly worthwhile.

Ready to explore what Vietnamese shrimp suppliers can do for your business? The $2.5 billion question is: can you afford not to?