If you’ve been following the seafood industry, you already know 2025 has been quite the rollercoaster. But here’s something worth celebrating: Vietnam’s pangasius sector just crossed a milestone that many thought wouldn’t happen this year. Despite economic headwinds, trade tensions, and the ever-present supply chain challenges, Vietnam pangasius export has officially hit the $2 billion mark in just eleven months.

At VNSeafoodInsider, we’ve been tracking this incredible journey throughout the year, and honestly, it’s been fascinating to watch. The pangasius price increase 2025 has been a double-edged sword—challenging for buyers, profitable for producers, and ultimately reflective of a maturing industry that’s learning to balance growth with sustainability. Whether you’re an importer trying to navigate these choppy waters, a distributor planning your 2026 strategy, or just someone who cares about where your fish comes from, this story has something for you.

Let’s dive into what’s really happening in Vietnam’s pangasius industry and what it means for the global seafood market.

Outline

ToggleVietnam Pangasius Export Reaches Historic $2 Billion in 11 Months

The numbers don’t lie, and they’re pretty impressive. Vietnam’s pangasius industry wrapped up November 2025 with total export revenues exceeding $2 billion for the first eleven months—a solid 9% increase compared to the same period in 2024. November alone brought in $195 million, maintaining that steady 9% year-over-year growth momentum.

To put this in perspective, pangasius now accounts for roughly 20% of Vietnam’s total seafood exports. That’s substantial, especially when you consider the challenges the industry has faced, from disease outbreaks in previous years to the ongoing recalibration of global trade relationships.

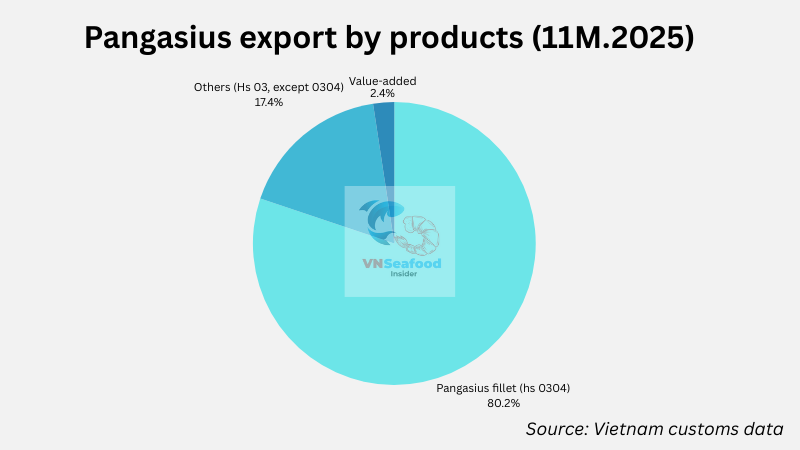

What’s particularly interesting is how this growth is distributed across different product categories. The breakdown reveals a lot about where the market is heading and what consumers actually want:

Pangasius fillets (classified under HS code 0304) dominated the export portfolio, bringing in $1.6 billion. This represents the lion’s share of exports and confirms what we’ve been saying for years—convenience matters. Buyers want ready-to-cook products that minimize processing on their end.

Other pangasius products (HS 03, excluding 0304) contributed $348 million to the total. These include whole fish, portions, and various cuts that cater to different market segments and culinary traditions.

Value-added products reached $48 million, and while this might seem small compared to the other categories, it’s actually a bright spot. Value-added items—think pre-marinated fillets, seasoned portions, or ready-to-eat formats—represent where the industry is trying to go. They offer better margins and respond to the growing consumer demand for convenience without compromising on quality or taste.

The achievement becomes even more remarkable when you consider the global economic uncertainties that marked 2025. Inflation concerns, fluctuating currency values, and geopolitical tensions could have easily derailed this growth trajectory. But Vietnamese catfish market trends showed resilience, adaptability, and a willingness to meet buyers where they are.

Key Export Markets Performance in 2025

Understanding where the fish goes helps explain why prices moved the way they did. The market dynamics in 2025 told a story of shifting power, emerging opportunities, and some traditional challenges.

Top Markets by Revenue (Jan-Nov 2025)

China (including Hong Kong) claimed the top spot as the largest importer of Vietnamese pangasius, accounting for $541 million in total purchases through November. The Chinese market has been particularly strong, with November alone bringing in $59 million—a robust 17% increase year-over-year. The timing makes sense; demand typically surges ahead of the Lunar New Year as families stock up for holiday celebrations. This reliable seasonal boost has made China an increasingly important partner for Vietnamese exporters.

The United States maintained its position as the second-largest market with $307 million in total imports, but the story here is more complicated. While the yearly numbers held steady, November saw a concerning 23% decline compared to the previous year. At VNSeafoodInsider, we’ve been hearing whispers about the upcoming 20% countervailing duties expected in 2026, and it seems buyers might already be adjusting their strategies accordingly. Some importers have been front-loading purchases earlier in the year, which could explain the November dip.

Brazil emerged as the third-largest market with $159 million in imports, posting an impressive 13% annual growth. The Brazilian market has been a pleasant surprise, demonstrating consistent appetite for affordable, quality protein sources as the country’s middle class continues to expand.

Regional Analysis and Challenges

The European Union market presented one of the year’s bigger disappointments. November exports to the EU reached just $12 million, down 25% year-over-year. The decline wasn’t uniform across the continent, though. Major markets like the Netherlands saw an 18% drop, while Germany experienced a 20% decline. These traditional European markets have been cooling on pangasius for several reasons—economic pressures reducing consumer spending, increased competition from other protein sources, and perhaps some lingering questions about sustainability certifications.

Emerging Markets: The Bright Spots

But here’s where things get exciting. While some traditional markets struggled, several emerging destinations showed remarkable growth, validating the industry’s diversification strategy:

Mexico absolutely exploded with growth, reaching $8 million in November exports—a stunning 50% increase. The Mexican market has been discovering pangasius as an affordable alternative to other whitefish, and the cultural affinity for fish-based cuisine makes it a natural fit.

Thailand posted a 24% year-over-year increase, which might seem counterintuitive since Thailand has its own aquaculture industry. But Vietnamese pangasius has found a niche in Thai food processing and re-export markets.

Egypt grew by 33%, Russia surged 45%, and these aren’t flukes. They represent genuine market development opportunities that savvy exporters have been cultivating for years.

The diversification strategy is clearly paying dividends. By not putting all their eggs in the American or European baskets, Vietnamese exporters have built resilience into their business models. When one market slows, others pick up the slack.

Understanding the Pangasius Price Increase 2025

Now let’s talk about what everyone in the supply chain has been feeling in their wallets: the pangasius price increase 2025 that’s been making headlines and reshaping negotiations throughout the year.

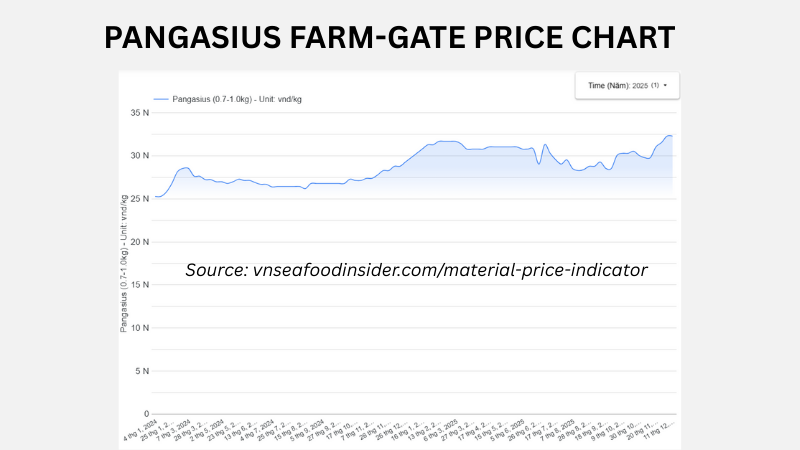

Farm-gate prices—what farmers actually receive when they sell their fish—hit approximately 32,000 VND per kilogram. For context, that’s significantly higher than the lows we saw just a couple of years ago when farmers were struggling to break even. Even fingerling prices, which indicate what farmers are willing to invest in their next crop, remained elevated, suggesting confidence in sustained higher prices.

What’s Really Driving These Price Increases?

The price surge isn’t arbitrary; it’s the result of several converging factors that created a perfect storm in the pangasius market.

Limited supply has been the elephant in the room all year. After several challenging years when prices were depressed, many farmers reduced their stocking volumes. It’s a rational response—why invest in raising fish when you can’t make money doing it? The problem is that aquaculture doesn’t turn on a dime. It takes months to raise pangasius to market size, so even when prices started recovering, the supply couldn’t immediately adjust upward. We’re essentially still dealing with the production decisions farmers made six to nine months ago, when the market looked very different.

The pangasius raw material shortage has been particularly acute for larger fish sizes that certain markets prefer. When supply is tight, buyers end up competing for available inventory, and that competition naturally pushes prices higher.

On the demand side, several positive developments have kept buyers coming to the table despite higher prices. Strong Chinese demand ahead of the Lunar New Year provided predictable buying pressure. Chinese consumers associate fish with prosperity and good fortune during the holidays, making it a non-negotiable purchase regardless of price fluctuations.

Meanwhile, growing demand from emerging markets like Mexico, Egypt, and Russia added incremental pressure. These buyers are less price-sensitive than some traditional markets because pangasius still represents tremendous value compared to local protein sources.

Then there’s the cost side of the equation. Production costs throughout 2025 remained stubbornly high. Feed costs—which represent the largest single expense in vietnam pangasius farming—stayed elevated as global grain prices remained above historical averages. Labor costs increased as Vietnam’s economy continues to develop and workers have more employment options. Operational expenses, from electricity to transportation, all trended upward.

Perhaps most significantly, the industry’s investment in quality and traceability systems added costs that ultimately get reflected in prices. Installing monitoring systems, maintaining certification compliance, and documenting the supply chain from farm to export all require resources. But these investments are exactly what differentiates Vietnamese pangasius in global markets where consumers increasingly care about sustainability and food safety.

Pangasius Raw Material Shortage: Causes and Implications

The pangasius raw material shortage deserves closer examination because it’s been the underlying driver of much of 2025’s market dynamics. At VNSeafoodInsider, we’ve visited farms throughout the Mekong Delta, and the story on the ground is consistent: farmers are being more cautious than ever.

Why Is There a Shortage?

Reduced farming volumes compared to previous years stem directly from the painful lessons of the past. During the pandemic years and immediately after, pangasius farmers experienced severe price crashes that made operations unprofitable. Many farmers left the industry entirely, while those who remained scaled back operations to reduce risk. This conservative approach makes sense from an individual farmer’s perspective, but collectively it’s created a supply bottleneck.

Seasonal factors always play a role in aquaculture. Pangasius grows more slowly during colder months, which means fish stocked in late 2024 or early 2025 took longer to reach market size than they would have during warmer periods. This natural rhythm created predictable supply constraints during certain months.

Farmers’ cautious stocking strategies reflect a broader shift in mindset. After years of boom-and-bust cycles, farmers are prioritizing stability over volume. They’re stocking fewer ponds but managing them more intensively to maximize survival rates and quality. This approach reduces risk but also reduces total output.

The limited availability of large-size fish has been particularly challenging for markets like Canada, Egypt, where consumers prefer thicker fillets. When large fish are scarce, processors either have to pay premium prices for them or adjust their product mix toward smaller portions that other markets favor.

See more: Vietnamese Whitefish Alternatives: Is it a Solution to EU’s Seafood Shortage Crisis?

The Quality Versus Quantity Trade-Off

Here’s where things get interesting, though. The shortage hasn’t been entirely bad news. It’s forced a focus shift toward premium product segments that actually benefits the industry’s long-term positioning. When volume is limited, it makes sense to chase higher-value markets rather than competing solely on price.

Vietnamese exporters have responded by investing in sustainable aquaculture practices that appeal to conscious consumers in developed markets. These aren’t just marketing claims—farms are genuinely adopting better environmental management, reduced antibiotic use, and improved animal welfare standards.

Enhanced traceability systems meeting international standards have become the norm rather than the exception. Buyers can now track fish from specific farms through processing and export, providing the transparency that retailers and consumers increasingly demand.

ASC (Aquaculture Stewardship Council) and BAP (Best Aquaculture Practices) certifications are gaining real importance. What used to be nice-to-have differentiators are becoming mandatory requirements for accessing premium markets. The good news is that Vietnamese producers have embraced these standards faster than competitors in other countries.

How the Industry Is Adapting

Processors are managing inventory strategically, holding stock when prices are favorable and releasing products to meet specific orders. This financial juggling requires capital and risk tolerance, but it helps smooth out some of the volatility.

Long-term contracts with reliable farmers have become more common. By guaranteeing farmers a stable offtake and reasonable prices, processors can ensure more predictable supply. These partnerships represent a maturation of the industry from spot-market chaos toward more professional, relationship-based commerce.

Technology adoption for better yield management is accelerating. From oxygen monitoring systems to automated feeding platforms, farms are using technology to get more output from existing resources. These investments pay for themselves through improved feed conversion ratios and reduced mortality.

Diversification of product offerings, particularly the growth in value-added products we mentioned earlier, helps processors maximize revenue from limited raw materials. A kilogram of fish that becomes a premium pre-marinated portion generates more profit than basic frozen fillets.

Vietnamese Catfish Market Trends and Global Competition

Stepping back from the immediate supply-and-demand dynamics, it’s worth examining where Vietnamese catfish market trends are heading and how Vietnam maintains its dominant position.

Vietnam’s Global Positioning

Vietnam remains the world’s largest pangasius exporter, controlling more than 50% of global production. That’s market power, but it also comes with responsibility. Vietnamese pangasius has become synonymous with the species in many markets, which means quality issues anywhere in Vietnam can affect the entire industry’s reputation.

Industry projections suggest pangasius could see 7% annual growth continuing through 2025 and beyond, according to market research from Asemconnect Vietnam. This optimistic outlook is based on several competitive advantages that aren’t easily replicated.

Stable supply remains a core strength despite the current shortage. Vietnam’s aquaculture infrastructure, from hatcheries to feed mills to processing plants, represents decades of development and billions of dollars in investment. Competitors can’t simply replicate this ecosystem quickly.

Traceability capabilities now match or exceed those in other aquaculture sectors. When food safety scares occur in global markets, buyers know they can rely on Vietnamese exporters to provide documentation and verification.

The broader trend toward farmed fish and sustainability actually favors pangasius over wild-caught alternatives. As ocean fish stocks face increasing pressure, responsibly farmed freshwater fish presents an environmentally sound alternative. Consumer awareness of these issues is growing, particularly in North America and Europe, which bodes well for pangasius’s long-term prospects.

Market Dynamics and Consumer Preferences

The shift toward responsible aquaculture practices isn’t just happening in Vietnam—it’s a global movement. But Vietnamese producers have been relatively quick to adapt, recognizing that certification and compliance are investments rather than costs.

Growing consumer preference for sustainable seafood manifests differently across markets. In the U.S. and Europe, consumers actively seek certifications like ASC. In emerging markets, sustainability might take a backseat to price and availability, but even there, awareness is growing.

Increased demand for convenient formats is reshaping product development. Families are time-starved everywhere, and proteins that go from freezer to table quickly have real value. Fillets, pre-marinated products, and portion-controlled packs are all responding to this trend.

Value-added products gaining traction internationally represent the future. While they currently represent a small percentage of total exports, growth rates in this category exceed those of commodity products. Exporters who can develop innovative products that meet specific market needs will capture disproportionate value.

Competition and Differentiation

Vietnam doesn’t have the pangasius market to itself, of course. Competition from tilapia and other catfish species is real, particularly in price-sensitive markets. Tilapia, farmed in dozens of countries, offers buyers geographic diversification that pangasius can’t match.

However, Vietnam’s technological advantages in processing provide meaningful differentiation. Vietnamese processing plants are generally more modern, efficient, and quality-focused than competitors in many other countries. This translates into consistent product quality that buyers value.

Quality certifications as differentiation factors have become critical in this competitive landscape. When multiple suppliers can offer similar products at similar prices, certifications become the tiebreaker that wins the order.

Vietnam Pangasius Export Outlook for 2026

So what happens next? At VNSeafoodInsider, we’re cautiously optimistic about 2026, though some challenges will undoubtedly persist.

Growth Opportunities on the Horizon

Stable supply chain advantages will continue to favor Vietnamese exporters. The infrastructure, expertise, and relationships built over decades don’t disappear overnight. As global supply chains remain somewhat fragile post-pandemic, this reliability has real value.

Strong traceability systems position Vietnam well as regulatory requirements tighten globally. The EU’s upcoming regulations on deforestation-free supply chains and the U.S.’s enhanced Seafood Import Monitoring Program both favor suppliers who can document their operations thoroughly.

The growing consumer trend toward farmed fish and sustainable seafood tailwinds persist. As wild fish stocks face pressure and climate change impacts ocean ecosystems, responsibly farmed alternatives become more attractive. Pangasius fits this narrative well when produced according to best practices.

Expanding value-added product portfolios offer Vietnamese exporters a path to higher margins. As processing capabilities improve and product development teams better understand international market preferences, we expect continued innovation in this space.

Emerging market development potential remains substantial. While mature markets like the U.S. and EU may grow slowly, countries across Latin America, Africa, and Asia represent enormous untapped potential for affordable, quality protein.

See more: Top 20 biggest seafood companies in vietnam

Challenges and Realistic Expectations

The elephant in the room for 2026 is the expected 20% reciprocal duty that U.S. importers will face. This will make Vietnamese pangasius less price-competitive in the U.S. market unless currency movements or other factors offset the impact. We’re likely to see some volume shift to other markets as a result.

Price stabilization is expected as supply gradually adjusts to higher price levels. Farmers are stocking more ponds in response to improved profitability, which should ease the raw material shortage by mid-2026. This will likely moderate prices from current levels.

Technology adoption improving efficiency will help control costs even as input prices remain elevated. Precision aquaculture techniques can improve feed conversion, reduce waste, and increase yields without proportionally increasing costs.

Sustainability certifications becoming market requirements rather than optional extras will continue to reshape the industry. Producers who haven’t yet invested in certification will find themselves excluded from premium markets. This will create a two-tier industry where certified farms command better prices while uncertified operations struggle.

What This Means for Seafood Importers and Distributors

If you’re a buyer reading this, you’re probably wondering how to navigate these trends. Here’s our practical take, based on conversations with importers who’ve successfully managed the pangasius price increase 2025.

Smart Procurement Strategies

Expect continued price pressures in Q1 2026, especially if you’re buying larger fish sizes. The Lunar New Year will drive Chinese demand, and the raw material shortage won’t resolve overnight. Budget accordingly and communicate with your end customers about likely price adjustments.

Building long-term supplier relationships isn’t just feel-good advice—it’s practical business sense when markets are tight. Suppliers who know you’re a reliable, reasonable partner will prioritize your orders when allocation decisions must be made. Conversely, buyers who only show up when prices are low shouldn’t expect preferential treatment when supply is constrained.

Consider alternative markets for sourcing or at least understand your options. While Vietnam dominates pangasius production, other countries like Indonesia and Bangladesh have growing industries. Diversifying your supplier base geographically provides options if Vietnamese exports face disruptions.

Diversify your product portfolio to manage risk. Don’t rely exclusively on pangasius or any single species. Having relationships across multiple proteins gives you flexibility when market conditions shift.

Quality Considerations

Verify supplier certifications (ASC, BAP) and understand what they actually mean. Not all certifications are equally rigorous or recognized, so do your homework. Request documentation and periodically audit your suppliers to ensure compliance.

Ensure traceability documentation is complete and accurate. As regulations tighten, the burden of proof will increasingly fall on importers. Work with suppliers who can provide comprehensive documentation from farm to export.

Evaluate supplier sustainability practices beyond just certifications. Visit farms when possible, ask detailed questions about environmental management and social responsibility, and choose partners whose values align with yours and your customers’.

Consider value-added products for margin improvement. Yes, they cost more to buy, but the convenience premium you can charge customers often more than compensates. Value-added products also differentiate your offering from competitors selling commodity frozen fillets.

Market Opportunities

Despite challenges, real opportunities exist for buyers who approach the market strategically.

Growing consumer demand for affordable, sustainable protein is a long-term structural trend. Pangasius fits this profile perfectly when sourced from certified farms. Educating your customers about the sustainability story can help justify premium pricing.

Emerging markets showing strong growth potential might be outside your current geographic footprint, but they’re worth exploring. If you’re selling primarily in traditional markets, consider whether expansion into Latin America, Africa, or other developing regions makes sense.

Value-added products offering differentiation can help you stand out in crowded markets. Work with Vietnamese processors to develop products tailored to your specific customer needs rather than just buying standard catalog items.

Partnership opportunities with Vietnamese exporters go beyond simple buyer-seller relationships. Joint product development, shared market intelligence, and collaborative promotion can create value for both parties that simple transactional relationships cannot.

Wrapping Up: What Vietnam’s $2 Billion Milestone Really Means

The Vietnam pangasius export milestone of $2 billion isn’t just a number—it represents an industry that’s matured, adapted, and positioned itself for continued relevance in global seafood markets. The pangasius price increase 2025, while challenging for buyers, reflects genuine supply-demand dynamics rather than speculation or manipulation.

At VNSeafoodInsider, we see this milestone as validation of the Vietnamese aquaculture sector’s resilience and professionalism. The pangasius raw material shortage that drove prices higher also forced improvements in quality, sustainability, and traceability that will benefit the industry for years to come.

The Vietnamese catfish market trends we’ve examined—diversification into emerging markets, development of value-added products, adoption of certifications, and investment in technology—all point toward a maturing industry that’s learning to create value rather than just compete on volume.

For 2026 and beyond, challenges certainly exist. Trade policies, currency fluctuations, disease risks, and competitive pressures aren’t going away. But the fundamentals remain strong: Vietnam has the infrastructure, expertise, and commitment to remain the world’s leading pangasius exporter.

For buyers, the message is clear: adaptability and partnership will be more important than ever. The days of simply shopping for the lowest price are fading. Success in this market will require understanding supply chain realities, building genuine relationships with suppliers, and positioning pangasius appropriately in your product portfolio.

The $2 billion milestone is worth celebrating, but it’s also just a waypoint on a longer journey. Where Vietnam’s pangasius industry goes from here depends on continued investment in quality, ongoing commitment to sustainability, and the willingness of buyers and sellers to work together rather than simply against each other.

We’ll be watching closely, and we’ll keep you informed every step of the way.

What are your experiences with the pangasius market in 2025? How are you preparing for 2026? Share your thoughts in the comments below—we’d love to hear from you.