The Vietnamese Pangasius Prices landscape is experiencing significant shifts as the industry navigates through an unexpected fingerling shortage. This supply chain disruption is sending ripples throughout the entire pangasius ecosystem, affecting everyone from small-scale farmers to major exporters. Let’s dive into how these market dynamics are reshaping the industry’s trajectory.

Outline

ToggleVietnamese Pangasius Export Performance Continues Strong Growth

Despite supply challenges upstream, the export story remains remarkably positive. September delivered impressive results with Vietnamese pangasius export figures reaching nearly $191 million, marking an 11% increase that surprised many industry watchers.

The nine-month cumulative performance tells an even more compelling story. Total exports have exceeded $1.6 billion, representing nearly 10% year-over-year growth. This resilience demonstrates the industry’s remarkable ability to adapt and thrive amid global uncertainties.

Three key markets are driving this momentum forward. China’s demand recovery has been particularly noteworthy, with buyers returning to Vietnamese suppliers after a period of market adjustment. The United States continues to show steady growth, maintaining its position as a reliable market for premium pangasius products. Perhaps most exciting are the emerging opportunities in Middle East markets, where Vietnamese exporters are successfully establishing new partnerships.

This Vietnamese pangasius export performance showcases the industry’s resilience amid ongoing global trade barriers. Vietnamese suppliers have positioned themselves as reliable partners, consistently delivering quality products while navigating complex international trade dynamics. The numbers speak volumes about the sector’s fundamental strength and adaptability.

See more: Pangasius Quality Control – How to Avoid Quality Issues When Importing Pangasius

Pangasius Fingerling Shortage Tightens Supply Chain

Here’s where things get interesting – and challenging. The fingerling market has become a real bottleneck, creating ripple effects throughout the entire production chain.

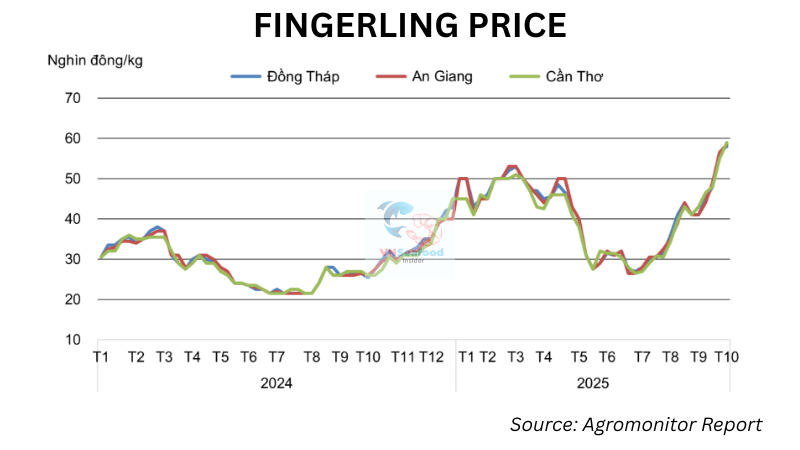

Current market conditions paint a stark picture. Fingerling prices have surged dramatically to 55,000-60,000 VND per kilogram for the standard size of 30-35 pieces (VASEP source). This represents a significant jump that’s caught many farmers off guard. The supply scarcity intensified notably during September, creating what industry insiders are calling a “perfect storm” of limited availability and rising demand.

Farmers are feeling the pinch directly. Many are delaying their stocking decisions, waiting to see if prices might stabilize. October has seen reduced pond restocking rates as farmers weigh their options carefully. This hesitation creates uncertainty about upcoming production cycles, potentially affecting future raw material availability.

Several root causes are contributing to this shortage. Weather patterns have disrupted traditional breeding schedules, while hatchery capacity constraints limit the industry’s ability to quickly respond to demand spikes. The seasonal supply-demand mismatch has become more pronounced, highlighting vulnerabilities in the current production system.

See more: Inside Vietnam Pangasius Farming What Every Seafood Importer Must Know Before Buying

How Fingerling Costs Affect Vietnamese Pangasius Prices

The connection between fingerling shortage and Vietnamese Pangasius Prices is straightforward but significant. When fingerling costs spike, the impact cascades through every stage of the value chain.

Raw material prices have already increased by 5% in recent periods, directly correlating with fingerling scarcity. This price transmission follows a predictable pattern: fingerling price increases affect grow-out farmers first, who then pass costs to processors, who ultimately adjust their pricing to exporters and international buyers.

The market dynamics have shifted the balance of power temporarily. Buyers are finding themselves in more competitive situations, while sellers with existing inventory enjoy stronger negotiating positions. This Vietnamese Pangasius Prices adjustment reflects the industry’s natural response to supply constraints.

Understanding this cost structure helps explain why even small changes in fingerling availability can have outsized impacts on final product pricing. The mathematics are simple: when foundation costs rise, everything built on top must adjust accordingly.

Pangasius Raw Material Costs and Market Outlook

Looking at current raw material price trends, processors are actively managing cost structures while maintaining quality standards. The 5% increase in raw material costs requires careful balance between profitability and market competitiveness.

Year-end demand projections offer reasons for optimism. Holiday season ordering patterns typically accelerate in Q4, and 2025 appears to be following this trend. Industry experts expect Q4 demand acceleration, which could help absorb the higher costs currently flowing through the system.

The 2025 forecast looks particularly promising. Vietnam’s seafood industry is targeting $10 billion in total exports, with projected growth rates of 10-12%. Vietnamese pangasius export will play a crucial role in achieving these ambitious targets, building on the strong performance demonstrated throughout 2025.

Supply-side considerations for Q4 and 2026 remain complex. While current fingerling shortages create near-term challenges, the industry’s track record suggests solutions will emerge. Hatchery expansion, improved breeding programs, and better supply chain coordination are likely responses to current constraints.

See more: Seafood Quality Control Vietnam: Complete Guide to Avoid Oversoaked Products

Conclusion

The Vietnamese Pangasius Prices story in 2025 reflects both challenges and opportunities. While fingerling shortages have created supply chain tensions and price pressures, the strong export performance and growing global demand paint an optimistic picture for the industry’s future.

VNSeafoodInsider believes this situation demonstrates the pangasius industry’s fundamental resilience and adaptability. Yes, there are short-term adjustments to navigate, but the underlying market dynamics remain favorable.

If you’re involved in the Vietnamese pangasius trade, staying informed about these market developments is crucial. The industry continues evolving, and those who understand these dynamics will be best positioned for success. Consider connecting with VNSF Insider to discuss how these market changes might affect your sourcing strategies.

Pingback: Vietnam Seafood Export 2025: Top Markets & Importer Opportunities