The year 2026 has arrived with a significant wake-up call for Vietnam’s tuna industry. What seemed like distant regulatory changes have now become an immediate reality that’s reshaping global tuna trade dynamics. The MMPA tuna ban 2026 represents more than just another regulatory hurdle – it’s a fundamental shift that’s forcing Vietnam’s tuna sector to confront long-standing sustainability challenges while navigating increasingly competitive international markets. Let’s dive into what this means for the industry and global stakeholders.

Outline

ToggleVietnam Tuna Export Overview: Q3 2025 Performance Analysis

Before we examine the regulatory storm clouds gathering over Vietnam’s tuna industry, it’s crucial to understand where the sector stood heading into 2026. The performance data from 2025 tells a story of an industry already under pressure, making the MMPA compliance requirements even more challenging to navigate.

Vietnam’s tuna export journey through 2025 was nothing short of a rollercoaster ride. After months of concerning declines, August 2025 finally brought a glimmer of hope with a modest 1.4% increase, reaching over $91 million compared to the same period in 2024. However, this small victory couldn’t mask the broader challenges facing the industry.

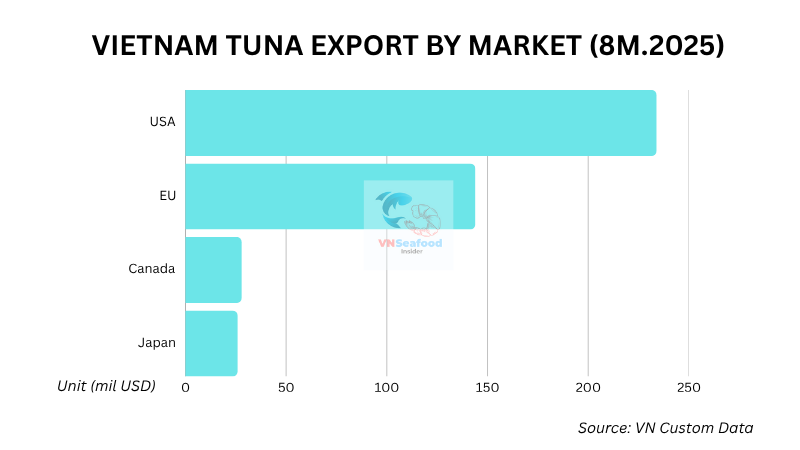

The eight-month cumulative data painted a sobering picture: Vietnam’s tuna exports reached only $633 million, representing a 2% decline compared to 2024. This downturn occurred even before the full impact of the MMPA tuna restrictions took effect, signaling that the industry was already grappling with multiple headwinds.

When we break down the numbers by product categories, an interesting pattern emerges. Fresh and frozen tuna products (HS CODE 03) showed resilience with $347 million in exports, marking a 1% increase. However, processed tuna products (HS CODE 16) struggled significantly, falling 6% to $286 million. This divergence suggests that while raw material demand remained relatively stable, value-added processing faced greater challenges – a trend that would become even more pronounced under the MMPA tuna ban 2026 restrictions.

See more: How Regulatory Changes Are Disrupting Vietnam’s Tuna Export Supply Chain in 2025

Understanding the MMPA Tuna Ban 2026: What Changed on January 1, 2026

The Marine Mammal Protection Act might sound like bureaucratic jargon, but its implications for Vietnam’s tuna industry are anything but academic. When the clock struck midnight on January 1, 2026, a new chapter began for international tuna trade – one that would test the adaptability of Vietnam’s fishing sector like never before.

MMPA compliance essentially requires that imported seafood products meet the same marine mammal protection standards that apply to U.S. fisheries. Think of it as a “level playing field” requirement, but one that demands significant changes to traditional fishing practices. The U.S. National Oceanic and Atmospheric Administration (NOAA) rejected the equivalency applications for 12 Vietnamese fisheries, effectively creating barriers for products from these operations.

The most critical impact centers on tuna fishing operations, particularly those using gillnet methods. Among the 12 rejected fisheries, code 13124 stands out as especially significant – it covers the capture of bigeye tuna, skipjack tuna, and yellowfin tuna using mid-water gillnets and purse seines. This represents a substantial portion of Vietnam’s commercial tuna operations.

But it doesn’t stop there. Code 13125, covering billfish and swordfish caught with mid-water gillnets and hand lines, also faces restrictions. Additionally, code 3057, which encompasses floating fish and tuna caught with gillnets, rounds out the tuna-specific impacts of the MMPA tuna ban.

The remaining nine fisheries span everything from grouper operations to lobster fishing, creating a web of compliance challenges that extend well beyond tuna. Each represents a piece of Vietnam’s complex fishing industry puzzle that must now adapt to meet U.S. marine mammal protection standards or face market exclusion.

US Market Pressure: Tariff Disadvantage Comparison

As if regulatory compliance weren’t challenging enough, Vietnam’s tuna industry faces a double blow from escalating tariff pressures. The competitive landscape has shifted dramatically, and the numbers tell a story that’s hard to ignore.

Currently, Vietnam faces a total tariff rate of 32.5% when exporting canned tuna to the United States – a combination of the basic 12.5% rate plus a 20% Reciprocal tariff. This places Vietnamese exporters at a significant disadvantage compared to key competitors who enjoy more favorable treatment.

Country Basic Tariff Reciprocal Tariff Total Tariff Rate |

Seychelles | 12.5% | 10% | 22.5% |

Ecuador | 12.5% | 15% | 27.5% |

Philippines | 12.5% | 19% | 31.5% |

Indonesia | 12.5% | 19% | 31.5% |

Thailand | 12.5% | 19% | 31.5% |

Vietnam | 12.5% | 20% | 32.5% |

Source: VASEP

The impact becomes crystal clear when you consider that Ecuador enjoys a 5-percentage-point advantage over Vietnam, while Seychelles benefits from a massive 10-percentage-point difference. In an industry where margins are often razor-thin, these tariff differentials can mean the difference between profitability and loss.

This tariff disadvantage has already begun affecting Vietnamese exporters’ order books. Combined with the looming MMPA tuna ban 2026, many U.S. buyers are increasingly looking toward alternative suppliers who offer both compliance certainty and better pricing structures.

Diversification Success: EU, Canada & Japan Growth Trends

While the U.S. market presents mounting challenges, Vietnam’s tuna industry has found reasons for optimism in other key markets. The diversification strategy that many exporters have pursued is beginning to show promising results, offering a potential lifeline as MMPA compliance issues complicate American market access.

The European Union continues to demonstrate its value as Vietnam’s second-largest tuna market, with exports reaching $144 million in the first eight months of 2025 – a solid 3% increase despite global headwinds. What’s particularly encouraging is the performance in specific EU countries that have embraced Vietnamese tuna products.

Netherlands emerged as a standout performer, recording an impressive 40% growth in tuna imports from Vietnam. This surge reflects the country’s role as a key distribution hub for the broader European market. Similarly, Italy showed remarkable growth of 43%, indicating strong consumer acceptance and potentially opening doors for premium product positioning.

The Canadian market delivered another bright spot with 20% growth, reaching $28 million in exports. This performance is particularly significant given Canada’s proximity to the U.S. market and similar consumer preferences, suggesting that Vietnamese tuna can successfully compete in North American markets when regulatory barriers don’t interfere.

Perhaps most impressive was Japan’s 22% growth, with imports reaching $26 million. This is noteworthy because Japan represents one of the world’s most sophisticated tuna markets, where quality standards are exceptionally high. The strong growth suggests that Vietnamese tuna operations are successfully meeting these demanding requirements.

For importers in these growing markets, Vietnam’s challenges in the U.S. market may actually present opportunities. As Vietnamese exporters seek to diversify away from America, they may offer more competitive pricing and dedicated service to buyers in the EU, Canada, and Japan.

See more: Top 20 biggest seafood companies in vietnam

Global Impact: What This Means for Tuna Importers Worldwide

The ripple effects of the MMPA tuna ban 2026 extend far beyond Vietnam’s borders, creating a complex web of supply chain implications that astute importers worldwide need to understand. The global tuna market is more interconnected than many realize, and disruptions in one major supply source inevitably affect pricing, availability, and sourcing strategies across all markets.

Supply chain disruption risks are perhaps the most immediate concern. Vietnam has historically been a reliable supplier of competitively priced tuna products, particularly in the processed segment. With potential restrictions on certain Vietnamese tuna operations, global supply volumes may tighten, especially for specific product categories that Vietnam has traditionally dominated.

Smart importers are already developing alternative sourcing strategies to mitigate these risks. This means diversifying supplier bases, potentially accepting higher costs for supply security, and building relationships with producers in countries like Ecuador, Thailand, and the Philippines. However, each alternative comes with its own challenges – Ecuador’s production capacity has limits, while Thailand and the Philippines face their own regulatory and sustainability pressures.

The price implications are complex and multifaceted. In the short term, reduced Vietnamese supply to the U.S. market might actually benefit importers in other regions, as Vietnamese exporters may offer more competitive pricing to secure market share in the EU, Canada, and Japan. However, medium-term effects could include overall price increases as global supply-demand dynamics adjust to the new regulatory reality.

For tuna importers, this environment demands greater strategic thinking. Simply chasing the lowest price is no longer sufficient – sustainability credentials, regulatory compliance, and supply chain reliability have become equally important factors in sourcing decisions.

See more: Top 5 exotic vietnam white fish that the importers should consider

Outlook 2026: Strategic Adaptations for Vietnam Tuna Sector

As we look ahead through 2026 and beyond, Vietnam’s tuna industry faces a critical juncture that will define its future competitiveness. The MMPA tuna ban represents both a significant challenge and an opportunity for transformation – but success will require decisive action and strategic thinking.

Certification pathways offer the most direct route back to U.S. market access. Vietnamese fishing operations must work closely with international certification bodies to demonstrate compliance with marine mammal protection standards. This process isn’t quick or inexpensive, but it represents the clearest path forward for operations currently affected by the MMPA restrictions.

The industry must also embrace market repositioning strategies that leverage its strengths while addressing regulatory challenges. This could involve focusing on premium product segments where sustainability credentials command higher prices, or developing specialized products for markets that value Vietnamese processing expertise.

Long-term competitiveness will depend on the industry’s ability to view current challenges as catalysts for necessary modernization. Vietnamese tuna operations that emerge from this period with robust sustainability credentials and diversified market access will likely be stronger and more resilient than before.

At VNSeafoodInsider, we believe that while the MMPA tuna ban 2026 presents serious short-term challenges, it also creates an opportunity for Vietnam’s tuna industry to demonstrate its commitment to sustainable fishing practices. The companies that adapt quickly and effectively will not only survive this transition but may find themselves better positioned for long-term success in an increasingly sustainability-conscious global market.

The path forward isn’t easy, but it’s navigable. The key lies in viewing compliance not as a burden, but as an investment in the industry’s future – one that will pay dividends in market access, consumer trust, and competitive positioning for years to come.

Pingback: Tuna CO Treatment vs Natural Methods: Importers Need to Know

Pingback: EUR1 Certificate Bottleneck: Why Vietnam Tuna Export EU Remains Limited