Vietnam’s tuna export supply chain just clocked $473 million in the first half of 2025 – sounds impressive, right? But here’s the plot twist that would make even seasoned industry veterans do a double-take. Behind this seemingly stable figure lies a story of regulatory upheaval that’s reshaping how Vietnamese tuna reaches global dinner tables.

While the numbers suggest business as usual with a modest 0.2% growth compared to 2024, the reality is far more complex. Decree 37/2024 has thrown a regulatory wrench into what was once a well-oiled export machine, creating ripple effects that extend from local fishing boats to international supermarket shelves. At VNSeafoodInsider, we’ve been tracking these developments closely, and what we’re seeing is a perfect storm of compliance challenges meeting market opportunities – with mixed results that deserve your attention.

Outline

ToggleVietnam’s Tuna Export Supply Chain Under Pressure

Let’s dive into the numbers that tell the real story of Vietnam’s tuna export performance in 2025. The headline figure of $473 million might look stable, but peel back the layers and you’ll find a market in transition.

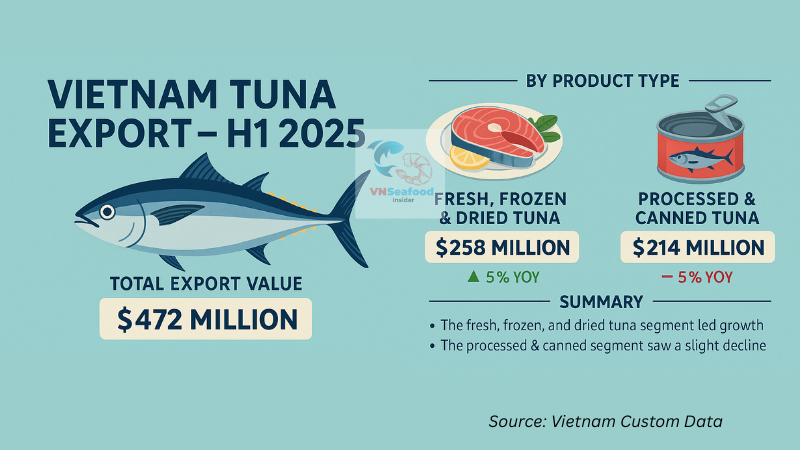

The first half of 2025 reveals a tale of two product categories moving in opposite directions. Fresh and frozen tuna products are swimming upstream with $258 million in exports, marking a solid 5% increase from the previous year. Meanwhile, processed tuna products – particularly the canned varieties that once dominated Vietnam’s export portfolio – are struggling against the current with $214 million, down 5% year-on-year.

This split isn’t just about consumer preferences; it’s a direct reflection of how regulatory changes are forcing Vietnamese exporters to adapt their supply chain strategies. Companies are finding it easier to maintain quality standards and traceability requirements for simpler products like frozen tuna loins, while the complex processing requirements for canned products are becoming increasingly challenging to navigate.

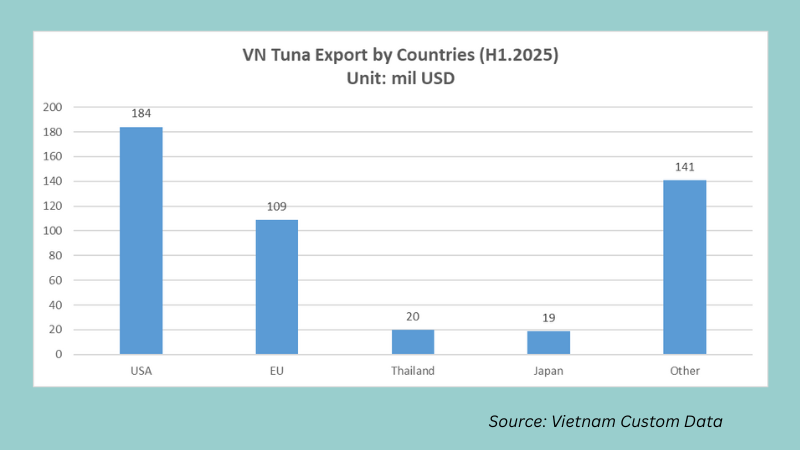

The geographic distribution of exports tells an equally compelling story. The United States remains Vietnam’s tuna export champion, absorbing $184 million worth of products – that’s nearly 39% of total exports and a healthy 7% increase from 2024. The European Union, despite regulatory hurdles, managed $109 million with a modest 1% uptick. But here’s where things get interesting: Thailand emerged as an unexpected star player with $20 million in imports, representing a jaw-dropping 137% surge that signals its growing role as a regional processing and re-export hub.

Decree 37/2024: The Root of Supply Chain Disruption

When Decree 37/2024 took effect on May 19, 2024, few anticipated the seismic shifts it would trigger across Vietnam’s tuna supply chain. What started as an effort to improve traceability and sustainable fishing practices has evolved into the industry’s biggest compliance headache in recent memory.

The decree’s most controversial provision – the 500mm minimum size requirement for skipjack tuna – has created an immediate supply crunch that’s reverberating throughout the entire tuna export supply chain. Local fishermen report that only 10-15% of their traditional catch meets this new standard, with the majority of skipjack tuna measuring between 30-40cm. This isn’t just a minor adjustment; it’s a fundamental disruption of established fishing patterns and supply relationships.

Processing companies have responded by dramatically reducing their purchases of domestically caught tuna, creating a domino effect that’s forcing businesses to look overseas for raw materials. The irony is palpable – a regulation designed to promote Vietnamese fishing sustainability is inadvertently pushing processors toward imported alternatives, undermining the very domestic supply chain it was meant to strengthen.

The administrative burden has multiplied exponentially. Companies now navigate a maze of documentation requirements, vessel registration protocols, and traceability standards that would challenge even the most compliance-savvy operations. The proposed shift toward quota management systems has sparked additional concerns about bureaucratic complexity, with many industry players worrying about further administrative bottlenecks.

EVFTA Benefits Eroding Due to Supply Chain Issues

Vietnam’s European tuna exports were supposed to be a Brexit-era success story, leveraging EVFTA benefits to capture market share from competitors. The reality, however, reads more like a cautionary tale about regulatory complexity undermining trade advantages.

The 11,500-ton annual quota for duty-free processed tuna exports to the EU typically exhausts within the first 4-5 months of each year. Once this preferential allocation disappears, Vietnamese exporters face steep MFN (Most Favored Nation) tariffs that effectively price them out of competitive bidding. It’s like having a golden ticket that expires just when you need it most.

The real kicker? The percentage of Vietnamese tuna products qualifying for preferential treatment under EVFTA has plummeted from 80-100% in the agreement’s early years to just 30% recently. This dramatic decline directly correlates with the implementation of stricter origin and traceability requirements under Decree 37/2024.

Vietnamese processors are caught in a regulatory catch-22: comply with domestic fishing regulations and lose access to competitively priced local raw materials, or import materials and forfeit EVFTA benefits. Many are choosing the latter, fundamentally altering the structure of Vietnam’s tuna processing supply chain and reducing the value-add that keeps Vietnamese operations competitive against lower-cost regional alternatives.

See more: Selecting Premium Tuna Cuts for Sushi, A Guide for Seafood Importers

Market Adaptation and Regional Shifts

The beauty of global trade lies in its adaptability, and Vietnam’s tuna export sector is proving remarkably resilient despite regulatory headwinds. While traditional powerhouse markets like the US and EU navigate their respective challenges, emerging opportunities are reshaping the geographical landscape of Vietnamese tuna exports.

Thailand’s 137% import surge represents more than just impressive growth numbers – it signals a fundamental shift in regional supply chain dynamics. Thai processors are leveraging their strategic position as a hub for re-export operations, often adding value to Vietnamese raw materials before shipping to final destinations. This arrangement helps Vietnamese producers maintain market access while circumventing some direct export challenges.

The CPTPP markets collectively generated $62 million in Vietnamese tuna imports, up 11%, with particularly strong performances from Japan (24% growth) and Canada (15% increase). These markets are demonstrating greater appetite for premium fresh and frozen tuna products, aligning perfectly with Vietnam’s current production capabilities under the new regulatory framework.

Conversely, niche markets in regions like the Middle East are experiencing significant volatility. Ongoing conflicts have disrupted established trade relationships, with Israeli imports declining consistently throughout the first half of 2025. These geopolitical disruptions highlight the importance of market diversification in maintaining supply chain resilience.

See more: How to Negotiate Prices for Tuna Import from Vietnam

Outlook for Vietnam’s Tuna Export Supply Chain

Looking ahead, Vietnam’s tuna export industry stands at a critical juncture where regulatory compliance and market competitiveness must find common ground. The delayed revision of Decree 37/2024 continues to create uncertainty, with businesses missing optimal fishing seasons while awaiting regulatory clarity.

The proposed quota management system could either streamline operations or create additional bureaucratic layers – the outcome depends largely on implementation details that remain frustratingly vague. Industry stakeholders are pushing for simplified procedures that maintain sustainability goals without sacrificing operational efficiency.

Supply chain diversification appears inevitable as companies adapt to new regulatory realities. We’re likely to see continued growth in imports of raw materials for processing, potentially transforming Vietnam from a fishing-based exporter to a processing-based one. This shift could actually strengthen long-term competitiveness by reducing dependence on domestic catch variability.

See more: Top 5 exotic vietnam white fish that the importers should consider

The EU quota situation requires urgent attention from policymakers. Current utilization rates suggest Vietnam may struggle to justify quota increases during 2027 renegotiations unless the percentage of qualifying products improves dramatically. This could limit future growth potential in one of the world’s most valuable tuna markets.

Market adaptation strategies are already emerging. Companies are investing in enhanced traceability systems, developing closer relationships with certified suppliers, and exploring value-added products that can command premium pricing despite higher compliance costs. The tuna supply chain of tomorrow will likely be more technology-driven, documentation-heavy, and regionally integrated than today’s operations.

For industry players navigating these choppy waters, success will depend on balancing regulatory compliance with operational flexibility. Those who can master this balance while maintaining product quality and cost competitiveness will emerge stronger from this period of unprecedented change in Vietnam’s tuna export supply chain.

The story isn’t over – it’s evolving. And at VNSeafoodInsider, we’ll continue monitoring these developments to help you stay ahead of the curve in this dynamic industry landscape.

Pingback: MMPA Tuna Ban 2026: Vietnam Industry Challenges & Impact