The Pangasius market is experiencing a real squeeze right now, and things are getting pretty wild. Potential US tariffs are hanging over everyone’s heads while China’s rock-solid demand keeps pushing all the right (and wrong) buttons. Vietnamese Catfish has been the reliable workhorse of global whitefish for years – affordable, versatile, dependable. But lately, prices are hitting levels we haven’t seen in ages, and raw material shortages keep popping up like unwelcome party crashers. If you’re making the big buying and selling calls, understanding these shifting currents isn’t just helpful – it’s make-or-break territory for your bottom line.

Outline

ToggleGlobal Pangasius Market Demand: Who’s Buying, Who’s Hesitating, and Why?

Alright, let’s talk about who’s hungry for Pangasius. The global appetite is still there, no doubt, but the flavour profile of demand is changing across key regions. It’s not just a simple story of ‘more please’; it’s a complex picture influenced by economics, politics, and good old-fashioned competition.

The US Market: Strong Appetite, Tangled in Tariffs

The United States has always been a major player in the Pangasius market, and demand remains fundamentally strong. Consumers appreciate its value. However, the situation is, shall we say, complicated. You’ve likely heard the buzz about potential US tariffs. This uncertainty has created a bit of a rush, with Vietnamese exporters pushing hard to get product stateside before any new duties kick in. It’s a classic ‘beat the clock’ scenario.

But here’s the twist: while overall demand seems robust, some of the biggest players, like Vinh Hoan Corporation (Vietnam’s top Pangasius exporter), have actually reported a dip in their US sales revenue recently – down 10% in April compared to last year. Why the contradiction? It boils down to that tariff uncertainty. While the immediate threat might be postponed, the potential for significant duties (we’re talking figures from 10% up to a hefty 46% being floated) makes long-term planning tricky for everyone involved, especially importers who ultimately bear the brunt of these costs. It’s a high-stakes waiting game, and it’s definitely impacting purchasing patterns and confidence within the Pangasius market focused on the US.

See more: Pangasius Fish Price Faces Pressure as U.S. Tariffs Hit Vietnam’s Major Processors

As our observation, May – June export volume will significantly increase to the US market because most factories will try to push all shipments out before the high reciprocal tariff takes effect.

China: Still a Powerhouse Buyer

China’s demand for Pangasius continues to be a significant driver for the Vietnamese industry. The sheer scale of the market keeps orders flowing. However, it’s not entirely smooth sailing here either. Even with strong underlying demand, recent reports indicate that export revenues from China have also seen a downturn for major suppliers. This could reflect broader economic factors within China, inventory adjustments, or perhaps increased price sensitivity. While still a crucial pillar for the Pangasius market, the China equation isn’t immune to fluctuations.

Europe: A More Cautious Approach?

Europe remains an important destination, but recent signals suggest a more cautious market. Similar to the US and China, major Vietnamese exporters have reported declining revnues from European buyers. Factors here could include economic pressures affecting consumer spending, strong competition from other whitefish options available locally, and perhaps a growing emphasis on sustainability certifications or specific product requirements. The European segment of the Pangasius market seems to be demanding, requiring careful navigation.

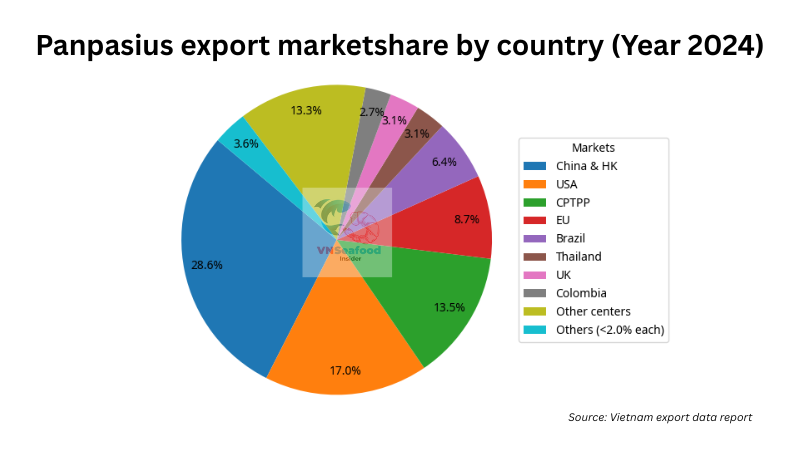

Beyond the Big Three: Diversification is Key

Facing challenges in traditional strongholds, Vietnamese exporters are smartly looking further afield. We’re seeing positive signs in other parts of Asia, particularly within the ASEAN bloc. Thailand, for instance, has notably increased its imports, becoming Vietnam’s top seafood customer in the region recently. This diversification strategy is crucial for resilience, spreading risk and tapping into new growth opportunities for the Pangasius market.

What’s Stirring the Pot? Demand Drivers & Inhibitors

So, what are the underlying forces shaping this demand landscape?

- Price Sensitivity: Pangasius built its reputation on affordability. When prices climb, as they have recently, buyers and consumers start looking closely at alternatives.

- Competition: It’s a crowded freezer case out there! Pangasius competes with tilapia, pollock, cod, haddock, and others. Interestingly, recent reports suggest decreased production or tighter fishing quotas for species like Alaskan Pollock and cod. This could actually boost demand for Pangasius as buyers seek reliable Vietnam white fish alternatives, a potential silver lining noted by industry leaders.

- Trade Policies: The elephant in the room, especially regarding the US. Tariff threats create uncertainty, disrupt planning, and can significantly impact landed costs.

- Economic Conditions: General economic health in importing countries directly impacts consumer spending on food items, including seafood.

- Consumer Preferences: Trends towards sustainability, traceability, and specific quality attributes continue to influence purchasing decisions.

Understanding this complex web of demand factors is step one in navigating the current Pangasius market squeeze.

See more: Top 20 biggest seafood companies in vietnam

Pangasius Supply Chain: Feeling the Pinch from Farm to Fillet

Now, let’s flip the coin and look at the supply side. If demand is one side of the squeeze, supply constraints and pricing are definitely the other. Vietnam is the undisputed king of Pangasius production, but even kings face challenges. The current situation on the ground is tight, and it’s having a direct impact on the Pangasius market globally.

The Great Fish Shortage (Well, Sort Of)

Okay, maybe

“shortage” is too strong a word, but sources on the ground confirm that the supply of harvest-ready fish felt decidedly tight through April and into May 2025. Think of it like trying to get concert tickets for the hottest band – everyone wants them, but there are only so many available right now. This tightness directly contributes to the firm pricing we’re seeing.

Adding another layer of complexity are whispers about potential raw material shortages later in the year. While fingerling supply saw its usual seasonal increase (and corresponding price dip), the pipeline for market-size fish might face pressure down the road. This is something savvy players in the Pangasius market are keeping a close eye on – planning inventory and securing orders becomes even more critical if future supply could be constrained.

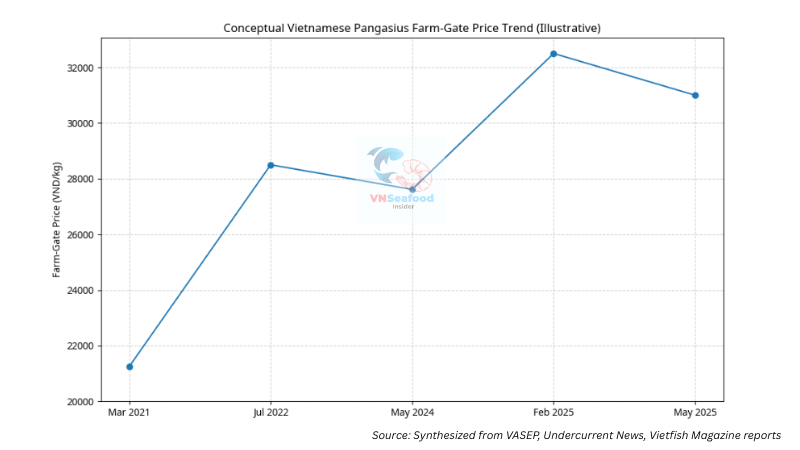

Pangasius Prices Climbing: The Five-Year Itch

Let’s talk numbers, because that’s where the squeeze really bites. Farm-gate prices – what farmers get paid for their fish – have been remarkably firm. In fact, reports from May indicated prices were hovering around a five-year high. Ouch. When the base cost of the raw material is elevated, that pressure inevitably works its way up the chain, impacting export quotes and, ultimately, the price you pay.

What’s fueling these high prices? It’s a classic mix:

- Tight Supply: As mentioned, fewer harvest-ready fish means farmers can command better prices.

- Input Costs: Feed costs and other farming expenses remain significant factors.

- Steady Demand: Despite regional wobbles, overall export orders provide a solid base demand that supports pricing.

This high-price environment makes navigating the Pangasius market particularly challenging for buyers focused on maintaining specific price points for their customers.

In the latest weeks of May, the price of pangasius material (main size 800-1000gr) is about 30.800- 31.200 vnđ/kg while bigger fishes (>1.2kg) will cost 32k-34k vnđ/kg (according to AgriMonitor market research)

Figure 1: Illustrative trend of Vietnamese Pangasius farm-gate prices, showing recent firmness and levels reported near five-year highs. (Data Source: Synthesized from VASEP, Undercurrent News, Vietfish Magazine reports)

Export Performance & Industry Plays: Rolling with the Punches

So, how are Vietnamese exporters, the engine room of the global Pangasius market, coping with this dynamic environment? They’re adapting, strategizing, and, like everyone else, trying to read the tea leaves on things like US tariffs. It’s a testament to the resilience of the industry.

The Big Picture of Pangasius Market: Exports Holding Up (Mostly)

Overall, Vietnam’s seafood export sector has shown resilience. While specific months or companies might see dips, the broader trend, especially coming out of previous volatile periods, has been one of recovery and growth. Pangasius remains a cornerstone of these exports. However, the recent figures from major players like Vĩnh Hoàn serve as a reminder that even market leaders aren’t immune to headwinds like trade policy uncertainty and shifting demand in key markets.

Adapting and Diversifying

Beyond individual company strategies, the broader Vietnamese industry is focused on adaptation. The push towards market diversification, lessening reliance on any single large market, is a clear trend. Strengthening ties within ASEAN and exploring other potential growth regions are key parts of this strategy. Furthermore, ongoing efforts focus on improving quality, sustainability certifications (a key factor in markets like Europe), and processing efficiency to maintain competitiveness in the global Pangasius market.

Pangasius Market Outlook & Your Playbook: Navigating the Next Few Months

Okay, let’s bring it all together. What does this squeeze mean for you, the importers, distributors, and wholesalers navigating the Pangasius market right now? Here’s VNSeafoodInsider’s take on the outlook and some strategic thoughts.

The Crystal Ball (Short-Term Forecast: 3-6 Months)

Predicting the future is always tricky, but based on current trends, here’s what the next few months in the Pangasius market might look like:

- Demand: Expect continued solid demand from China, while the US market remains clouded by tariff uncertainty. Any definitive news on US tariffs (either implementation or further delay/resolution) will be a major market mover. Europe likely remains steady but cautious.

- Supply: Supply of harvest-ready fish will likely remain relatively tight in the near term, supporting firm prices. Keep an ear out for updates on raw material availability for later in the year.

- Pricing: Farm-gate prices are likely to stay elevated as long as supply is constrained and input costs remain high. Export pricing will reflect this, potentially testing the limits of buyer price sensitivity.

- Volatility: The keyword is uncertainty, especially concerning US trade policy. Be prepared for potential price fluctuations and shifts in buyer sentiment based on news events.

Looking Further Ahead: Long-Term Currents

Beyond the immediate future, keep these factors on your radar:

- Sustainability: This isn’t going away. Sustainability Certifications (ASC, BAP) will likely become increasingly important, especially in Western markets.

- Aquaculture Tech: Advances in Vietnam pangasius farming technology could eventually impact efficiency, costs, and supply reliability in the Pangasius market.

- Competition: Keep watching the supply/demand dynamics of competing whitefish. Shifts here can create both challenges and opportunities for Pangasius.

Your Strategic Toolkit: Tips for Pangasius Buyers

So, how do you navigate this squeeze? Here are some thoughts for different players:

For Importers:

- Secure Supply: Given the tightness, maintaining strong relationships with reliable Vietnamese suppliers is paramount. Consider forward contracts where feasible, but be mindful of price volatility.

- Manage Price Risk: Stay glued to market reports. Understand the factors driving prices and communicate proactively with your suppliers and customers about potential fluctuations.

- Factor in Tariffs: If importing to the US, build potential tariff costs into your financial modeling. Understand your contractual terms regarding who bears the duty burden.

- Diversify Suppliers (Carefully): While loyalty is key, having alternative supplier options can provide flexibility, but ensure they meet your quality and reliability standards.

For Distributors & Wholesalers:

- Inventory Management: Balance the need to have stock against the risk of holding high-cost inventory if prices suddenly shift. Monitor sell-through rates closely.

- Product Positioning: Communicate the value proposition of Pangasius. If prices are high, emphasize quality, consistency, or specific attributes your supply offers.

- Customer Communication: Be transparent with your customers about the Pangasius market conditions. Explaining the reasons behind price levels can help manage expectations.

- Explore Alternatives (If Necessary): Understand your customers’ needs. If Pangasius prices become prohibitive for some, be ready to discuss alternative whitefish options.

Conclusion: Riding the Waves of the Pangasius Market

Whew! That’s the current state of play in the dynamic world of the Pangasius market. It’s clear we’re in a period of tightening supply, firm prices, and significant external pressures, particularly from trade policy uncertainties and shifting demand patterns in major markets like the US and China. It’s a squeeze, alright.

But the Vietnamese Pangasius industry and the global network that supports it are nothing if not resilient. Adaptation, diversification, and strategic planning are the names of the game. For you, our valued readers – the importers, distributors, and wholesalers who keep the seafood flowing – staying informed, maintaining strong partnerships, and being agile in your decision-making are more critical than ever.

Keep checking back with VNSeafoodInsider for the latest updates and insights. Navigating these waters might be challenging, but with the right information and a smart approach, you can successfully ride the waves of the ever-evolving Pangasius market.