The global seafood industry is facing a remarkable transformation, and at the heart of this change lies Vietnam’s thriving pangasius sector. As market dynamics shift and new opportunities emerge, Vietnam Pangasius Export has become the talk of international trade circles. What started as a challenging year has turned into an unexpected success story that’s catching the attention of importers worldwide.

Outline

ToggleVietnamese Panga Export Statistics Reveal Strong Market Performance in H1.2025

When VNSeafoodInsider first analyzed the early 2025 market trends, we predicted steady growth. But the reality has exceeded even our most optimistic projections. The numbers don’t lie – and they’re telling a compelling story of resilience and strategic positioning.

June 2025 marked a significant milestone for the industry. Vietnam Pangasius Export revenue reached an impressive $194 million, representing a robust 13% year-over-year growth. This single-month performance wasn’t just a lucky break; it reflected the culmination of strategic market positioning and improved production efficiency.

The bigger picture becomes even more exciting when you examine the cumulative figures. Vietnamese Pangasius exports for the first half of 2025 totaled $1.023 billion – that’s right, over a billion dollars – marking an 11% increase compared to the same period in 2024.

This growth momentum isn’t accidental. It’s the result of Vietnamese producers adapting to global market demands, improving quality standards, and diversifying their product offerings. The industry has learned from previous challenges and emerged stronger, more competitive, and better positioned for sustainable growth.

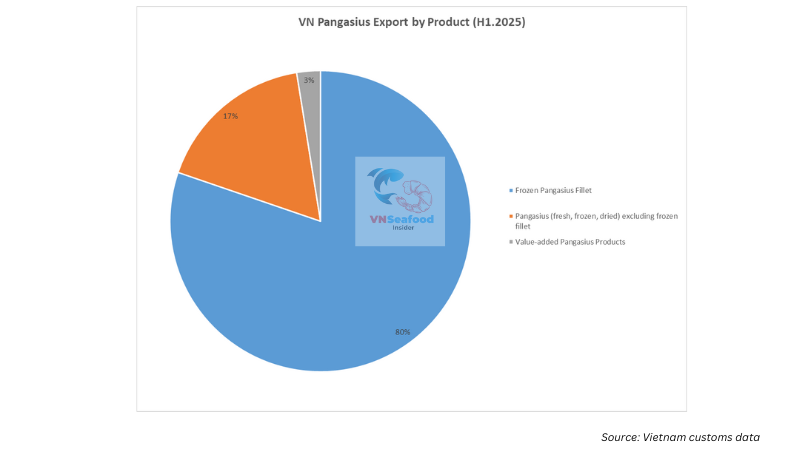

Product Portfolio Breakdown: Frozen Pangasius Fillets Dominate Vietnam Pangasius Export

Understanding the product mix is crucial for importers looking to capitalize on this growth trend. The Vietnam Pangasius Export portfolio reveals interesting patterns that savvy importers should note.

Core Product Categories Performance

Here’s how the $1.023 billion total breaks down across different product categories:

|

Product Category Value (USD Million) Percentage of Total |

|

HS03 Products |

$997 mil |

97.5% |

|

– Frozen Pangasius Fillets (HS0304) |

$821 mil |

80.3% |

|

– Other HS03 Products |

$176 mil |

17.2% |

|

HS16 Value-Added Products |

$26 mil |

2.5% |

|

Total |

$1,023 mil |

100% |

The dominance of frozen pangasius fillets is unmistakable, accounting for over 80% of total export value. This reflects the global preference for this versatile, ready-to-cook format that appeals to both foodservice and retail sectors.

However, the real story lies in the value-added segment. Despite representing only 2.5% of total volume, HS16 products grew by an impressive 48% year-over-year. This explosive growth in processed pangasius products signals a strategic shift toward higher-margin offerings – exactly what forward-thinking importers should be watching.

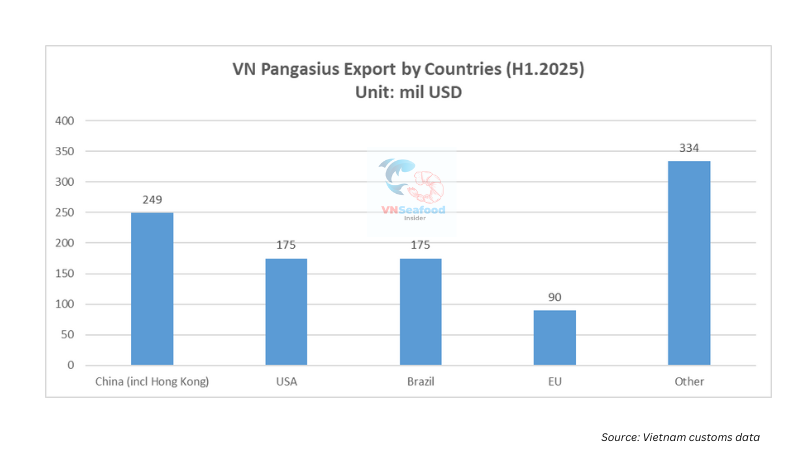

Key Destination Markets for Vietnam Pangasius Export in 2025

Market diversification has been a cornerstone of Vietnam’s export strategy, and the results speak volumes about the global appeal of Vietnamese Pangasius. Let’s examine where these products are finding their most receptive audiences.

China and Hong Kong remain the largest single market, importing $249 million worth of Vietnam Pangasius Export products in H1 2025. However, the 4% year-over-year decline suggests market saturation or shifting preferences that importers should factor into their strategies.

The United States presents a more encouraging picture with $175 million in imports, up 10% from the previous year. This growth occurs despite ongoing trade tensions and regulatory challenges, demonstrating the fundamental strength of pangasius import demand in the American market.

Brazil emerges as an equally important market, also reaching $175 million with 10% growth. This Latin American giant’s appetite for Vietnamese Pangasius reflects the product’s versatility and competitive pricing in diverse culinary cultures.

The European Union, while smaller at $90 million, showed steady 5% growth. Within the EU, the Netherlands continues its role as the gateway for Vietnam Pangasius Export into European markets, importing $26 million worth of products – an 11% increase that outpaced the overall EU growth rate.

See more: Inside Vietnam Pangasius Farming What Every Seafood Importer Must Know Before Buying

Pangasius Import Opportunities: US Market Dynamics and Tariff Impact

The US market deserves special attention from importers, not just for its size but for the unique dynamics currently shaping pangasius import opportunities. Recent policy changes have created both challenges and unexpected advantages.

Strategic Import Timing Before August 2025

Here’s where timing becomes everything. The implementation of a 20% reciprocal tariff on Vietnam Pangasius Export effective August 1, 2025, has triggered what industry insiders call the “early stocking” phenomenon. US importers are rushing to secure inventory before the tariff takes effect, creating immediate opportunities for those who can move quickly.

This urgency has prompted Vietnamese companies to pivot strategically. Rather than competing solely on price, many producers are focusing on high-value processed products that can better absorb the additional tariff burden while maintaining competitive margins.

Competitive Advantage from Brazil Tilapia Tariffs

Sometimes, opportunity comes from unexpected directions. The 50% tariff imposed on Brazilian tilapia imports (source by Undercurrentnews), also effective August 1, 2025, has created a golden window for Vietnamese Pangasius and tilapia products in the US market.

This development is particularly significant because it positions Vietnam Pangasius Export as the preferred whitefish alternative for American importers and consumers. The price differential created by Brazil’s punitive tariffs makes Vietnamese products even more attractive from a cost perspective.

Frozen Pangasius Fillets Market: Future Growth Projections

The trajectory for frozen pangasius fillets looks increasingly promising, driven by several converging factors that smart importers should understand and leverage.

Value-Added Product Expansion

The 48% growth in processed pangasius products isn’t just a statistic – it’s a signal of where the market is heading. Vietnamese producers are investing heavily in processing capabilities, quality enhancement, and premium product positioning.

This shift toward value-added products creates opportunities for importers willing to work with their Vietnamese partners on product development and market positioning. The margins are better, the differentiation is clearer, and the customer loyalty tends to be stronger.

Quality improvements and international certifications are becoming standard rather than exceptional. This evolution means that Vietnam Pangasius Export products are increasingly meeting the stringent requirements of developed markets while maintaining their cost competitiveness.

See more: Pangasius Fillet Grading: What Importers Must Know

Why Vietnam Pangasius Export Presents Golden Opportunities for Importers

VNSeafoodInsider has been tracking this industry for years, and we’ve rarely seen such a confluence of positive factors for importers considering Vietnamese Pangasius products.

The supply chain from Vietnam has proven remarkably stable, even through global disruptions. This reliability is invaluable in today’s uncertain trading environment. When you combine this stability with competitive pricing versus other whitefish options, the value proposition becomes compelling.

Growing demand in key markets isn’t just about volume – it’s about sophistication. Consumers are becoming more adventurous, foodservice operators are seeking versatile proteins, and retailers are looking for products that offer both quality and value. Vietnam Pangasius Export products tick all these boxes.

The ongoing quality improvements and expanding certifications portfolio mean that Vietnamese suppliers can meet increasingly demanding specifications while maintaining their cost advantages. This combination of improving quality and competitive pricing is rare in the protein industry.

See more: Top 20 biggest seafood companies in vietnam

Outlook: Vietnam Pangasius Export Poised for Continued Growth

Looking ahead to the second half of 2025 and beyond, several factors suggest that the current growth trajectory for Vietnam Pangasius Export is sustainable and potentially accelerating.

Market predictions for H2 2025 remain optimistic, with industry analysts expecting continued double-digit growth despite the tariff implementations. The key will be how successfully Vietnamese producers can navigate the shifting trade landscape while maintaining their competitive advantages.

Long-term growth drivers include expanding middle-class populations in key markets, increasing protein consumption globally, and the ongoing premiumization trend that favors quality products at reasonable prices. Vietnamese Pangasius is well-positioned to benefit from all these trends.

For importers and distributors, VNSeafoodInsider’s recommendation is clear: now is the time to establish or strengthen relationships with Vietnamese pangasius import suppliers. The current market dynamics create opportunities that may not persist indefinitely. Those who act decisively while maintaining focus on quality and sustainability will be best positioned for long-term success in this dynamic market.

The Vietnam Pangasius Export story of 2025 is still being written, but the first chapters suggest it will be a tale of growth, opportunity, and strategic success for those bold enough to participate.

Pingback: Vietnamese Pangasius Prices Update: Fingerling Shortage Impacts