Vietnam has long been recognized as one of the world’s leading seafood exporters, supplying shrimp, pangasius, tuna, and many other seafood products to the global market. In this article, we will analyze the comprehensive overview of Vietnam Seafood Export Products 2024 and anticipate the Market Trends in 2025.

Outline

ToggleI. Vietnam Seafood Export Overview in 2024

In 2024, despite economic challenges, Vietnam seafood export continued to grow, showing resilience and strong market demand.

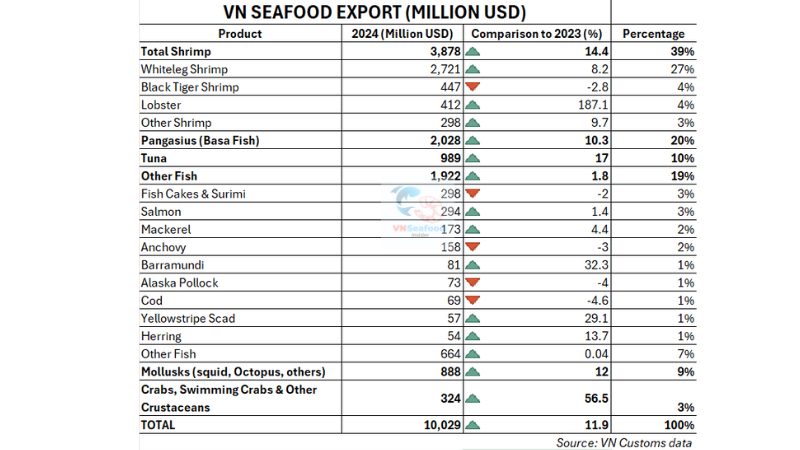

📌 Total seafood export value: $10.03 billion (+11.9% compared to 2023)

📌 Top markets: The United States, Europe, China, Japan, and South Korea

📌 Key drivers: Sustainability, improved processing technology, and strong global demand

Now, let’s dive into the most exported seafood products and their market performance!

II. Breakdown of Vietnam Seafood Export Products

1. Shrimp – The King of Vietnam Seafood Export Products (39%)

Shrimp remains Vietnam’s top seafood export, accounting for 39% of total seafood exports. In 2024, shrimp exports increased by 14.4%, reaching $3.88 billion.

✔ Vannamei Shrimp: The most exported shrimp species, generating $2.72 billion (+8.2%). Its affordability and high yield make it a popular choice.

✔ Lobster: The standout performer in 2024! With a 187.1% growth, lobster exports hit $412 million, thanks to rising demand from China and other Asian countries.

✔ Black Tiger Shrimp: Exported $447 million, but experienced a slight decline of -2.8% due to competition from other shrimp varieties.

2. Pangasius (Basa Fish) – Vietnam’s Competitive Advantage (20%)

Vietnam is the world’s largest exporter of pangasius, and in 2024, this sector saw a 10.3% increase, bringing in $2.03 billion.

✔ Pangasius is affordable, nutritious, and versatile, making it a favorite in both Western and Asian markets.

✔ The largest buyers of Vietnamese pangasius are China, the US, and the EU.

✔ Sustainable pangasius farming practices are helping boost exports, as more countries demand eco-friendly seafood.

3. Tuna – A Fast-Growing Sector in Vietnam Seafood Export Products (10%)

Tuna exports reached $989 million, growing by 17% from the previous year. The demand for tuna has been rising due to healthy eating trends, especially in the US and Japan.

✔ Processed tuna products, such as canned and frozen tuna, are becoming more popular.

✔ Vietnamese tuna exporters are focusing on quality certification to meet global standards.

4. Other Fish Products (19%) – A Strong Contributor to Vietnam Seafood Export

Vietnam exports a wide variety of fish, generating $1.92 billion in 2024. Some fish species performed exceptionally well:

✔ Mackerel: $173 million (+4.4%) – a popular choice in Europe and Asia.

✔ Barramundi: $81 million (+32.3%) – one of the fastest-growing seafood products!

✔ Yellowstripe Scad: $57 million (+29.1%) – rising demand from Southeast Asia.

Other species, such as fish cakes & surimi (-2%) and anchovy (-3%), experienced slight declines but remain essential parts of Vietnam seafood export products.

In recent time, because of the high tariff of Chinese originated tilapia, VN have increased Tilapia export.

See more post: Top 5 Tilapia Producers in Vietnam

5. Mollusks (Squid, Octopus, etc.) – A Key Component of Vietnam Seafood Export Products (9%)

Vietnam’s mollusk exports grew by 12%, reaching $888 million in 2024. The demand for squid and octopus is increasing in markets like Japan, Korea, and Spain, where these products are culinary staples.

6. Crabs & Other Crustaceans – The Fastest-Growing Sector in Vietnam Seafood Export (3%)

One of the biggest success stories in Vietnam seafood export this year is crabs and other crustaceans. With an incredible 56.5% growth, this category reached $324 million.

✔ China is a major buyer of Vietnamese crabs, and demand continues to rise.

✔ Vietnam’s high-quality soft-shell crabs are gaining international recognition.

III. Market Trends and Key Factors Impacting Vietnam Seafood Export

Vietnam’s seafood industry continues to grow, driven by increasing global demand, sustainability efforts, and economic conditions. Below are the key trends shaping Vietnam seafood export products and market.

1. Strong Demand from Key Markets

Vietnam’s seafood exports are benefiting from rising demand in key markets, including the United States, European Union, and China.

- United States and European Union: Consumers in these regions are becoming more health-conscious, leading to higher seafood consumption. Products like shrimp, pangasius, and tuna are in high demand due to their affordability and nutritional value. The EU-Vietnam Free Trade Agreement (EVFTA) has also helped lower tariffs, making Vietnamese seafood more competitive.

- China: After years of strict import restrictions due to the pandemic, China has relaxed regulations on seafood imports. This has led to a significant increase in demand for Vietnamese shrimp, lobster, and crab. The growing middle class in China is willing to pay more for premium seafood, creating an opportunity for high-value exports.

- Japan and South Korea: These markets prioritize high-quality, well-processed seafood. Vietnamese exporters are focusing on frozen and value-added seafood products, such as processed squid, octopus, and surimi, to meet consumer preferences in these countries.

2. Sustainability & Certification Matter

As global seafood buyers become more environmentally conscious, sustainability and certification have become critical factors in export success.

- Eco-Friendly Farming Practices: More Vietnamese seafood farms are adopting sustainable aquaculture methods to reduce their environmental impact. This includes using organic feed, reducing antibiotic use, and improving water treatment processes. These improvements help meet the sustainability standards required by major importers.

- Certifications Required for Export: Many global retailers and foodservice chains now demand certified seafood products. The most recognized certifications include:

- ASC (Aquaculture Stewardship Council): Ensures responsible farming practices for shrimp and pangasius.

- MSC (Marine Stewardship Council): Recognizes sustainable wild-caught seafood.

- BAP (Best Aquaculture Practices): Covers the entire supply chain, from hatcheries to processing plants.

- GlobalG.A.P.: Focuses on safe and sustainable aquaculture practices.These certifications not only open doors to premium markets like the US, EU, and Japan but also increase consumer trust in Vietnamese seafood.

- Traceability and Transparency: Importing countries, especially in Europe and North America, are enforcing stricter regulations on product origin and sustainability. To comply, Vietnam is investing in blockchain technology and digital tracking systems, allowing buyers to trace seafood products from farm to table. This ensures transparency in the supply chain and reduces the risk of illegal fishing accusations.

3. Global Economic Factors

Economic conditions worldwide are impacting Vietnam seafood export, influencing pricing, demand, and logistics.

- Exchange Rate Fluctuations: The value of the Vietnamese dong (VND) compared to the US dollar (USD), Euro (EUR), and Chinese yuan (CNY) plays a major role in determining export competitiveness. A weaker dong makes Vietnamese seafood more affordable for foreign buyers, boosting exports. However, a strong USD can make imports more expensive for some countries, reducing their purchasing power.

- Rising Logistics and Shipping Costs: Global supply chain disruptions have increased freight rates, making it more expensive to transport seafood to distant markets like the US and Europe. The rising cost of fuel and labor shortages in the logistics sector also contribute to higher transportation expenses, forcing exporters to adjust their pricing strategies.

- Competitive Pricing Advantage: Despite rising costs, Vietnam still maintains a cost advantage over many competitors. Shrimp and pangasius from Vietnam remain cheaper than salmon from Norway or tilapia from China, making them attractive options for price-sensitive buyers. By keeping production efficient and improving value-added processing, Vietnam can continue to offer high-quality seafood at competitive prices.

IV. Challenges and Future of Vietnam Seafood Export Products

While Vietnam seafood export continues to grow, the industry faces several challenges that need to be addressed to maintain competitiveness and sustain long-term success.

1. Rising Costs of Raw Materials & Production

The cost of raw materials, labor, and logistics is increasing, putting pressure on profit margins for seafood exporters.

- Higher feed prices: The cost of aquaculture feed has surged by 20-30%, mainly due to rising global grain prices and supply chain disruptions. Since feed accounts for nearly 60-70% of total farming costs, this directly affects the competitiveness of shrimp and pangasius exports.

- Labor shortages and higher wages: Many seafood processing plants struggle to find enough skilled workers, especially in peak seasons. As wages increase, companies must either automate production or improve worker productivity to offset costs.

- Rising freight and logistics expenses: The global shipping crisis has led to higher freight rates and longer delivery times, especially for shipments to the US and Europe. This makes Vietnamese seafood less competitive compared to countries with lower logistics costs.

- Electricity and fuel price hikes: Processing and cold storage facilities rely heavily on energy, and rising electricity costs increase overall production expenses.

To remain competitive, Vietnam must improve production efficiency, adopt energy-saving technologies, and optimize supply chain logistics to reduce unnecessary costs.

2. Competition from Other Countries

Vietnam is facing increasing competition from India, Ecuador, Indonesia, and Thailand, which are aggressively expanding their seafood export markets.

- India and Ecuador dominate shrimp exports: India is the largest shrimp exporter in the world, offering lower production costs and large-scale farming. Ecuador, known for its sustainable, antibiotic-free shrimp, has gained strong market share in Europe and the US. Vietnam must focus on higher-quality, value-added shrimp products to stay competitive.

- Indonesia and Thailand lead in tuna and squid exports: These countries have better-developed processing industries and strong government support, making them tough competitors in the frozen and canned seafood markets.

- China’s rising dominance in seafood exports: While China is one of Vietnam’s biggest buyers, it is also expanding its own tilapia and white fish production, competing directly with Vietnamese pangasius in some markets.

- Tilapia and cod as alternatives to pangasius: US and European consumers are increasingly choosing tilapia from China and Africa or wild-caught cod from Norway, challenging Vietnam’s pangasius exports.

Vietnam must focus on branding, sustainability certifications, and product differentiation to maintain its market position. Investing in high-tech farming, eco-certifications, and improved processing techniques can help Vietnam compete more effectively.

3. Future Opportunities for Vietnam Seafood Export

Despite these challenges, there are several opportunities for Vietnam’s seafood industry to expand and strengthen its position in the global market.

- Expanding into new markets: While the US, EU, and China remain key markets, Vietnam should increase seafood exports to the Middle East, Africa, and Latin America, where demand is rising. These markets have fewer trade barriers and lower competition, offering potential for diversification and growth.

- Developing value-added seafood products: Many consumers, especially in developed markets, prefer ready-to-eat and easy-to-cook seafood. By expanding into pre-marinated, pre-cooked, or premium frozen seafood, Vietnam can increase export value and appeal to higher-income customers.

- Investing in technology and smart farming: Adoption of AI-driven monitoring systems, automated feeding, and water quality management can improve farming efficiency and product quality. This will reduce disease outbreaks, improve sustainability, and ensure consistent supply, making Vietnamese seafood more attractive to global buyers.

By leveraging these opportunities, Vietnam seafood export can continue to thrive despite growing competition and economic challenges.

V. What’s Next for Vietnam Seafood Export?

Vietnam’s seafood industry remains a global powerhouse, with shrimp, pangasius, and tuna leading the way. Despite challenges like rising costs and competition, the industry’s commitment to quality, sustainability, and innovation will help secure long-term success.

As we move into 2025, all eyes will be on Vietnam seafood export products and markets to see how it continues to evolve and expand. Whether you’re a seafood importer, distributor, or enthusiast, Vietnam’s seafood industry is one to watch!

👉 What do you think about Vietnam’s seafood export growth in 2024? Let’s discuss in the comments!

Pingback: Top 20 Leading Seafood Companies in Vietnam

Pingback: Why Are US Buyers Switching to Tilapia Fish from Vietnam?

Pingback: Top 5 Leading Shrimp Processing Companies in Vietnam

Pingback: Discover Vietnam Pangasius Market Trends and Forecast 2025

Pingback: Vietnam Tuna Exports: Building Momentum for Growth in 2025

Pingback: 46% tariff! How US Reciprocal Tariffs impact Vietnam Seafood

Pingback: Pangasius Fish Price 2025 Faces Pressure as US Tariffs Hit Vietnam's Major Processors

Pingback: Looking for Golden Threadfin Bream Suppliers| Top Vietnam suppliers list

Pingback: Quality Frozen Mahi Mahi Fillets? Here's Why Vietnam Beats the Competition