Update on Apr 10, 2025 about US reciprocal tariffs impact Vietnam seafood: President Donald Trump declared a full three-month suspension of all “reciprocal” tariffs that took effect at midnight Apr 9, 2025—excluding those on China—in a surprising shift from his previous stance that record-high tariffs were permanent. This means that the rates of Vietnam in next 3 months will be reduced back to the standard 10%.

In the ever-changing landscape of international trade, Vietnamese seafood exporters find themselves navigating stormy waters following the United States’ announcement of a reciprocal tariff on Vietnamese goods. This unexpected wave has sent ripples through Vietnam’s seafood industry, threatening to disrupt one of the country’s most vital export sectors. At VNSeafoodInsider, we’ve analyzed how these US reciprocal tariffs impact Vietnam seafood businesses and what strategies companies can employ to stay afloat in these challenging times.

Outline

ToggleUnderstanding the US Reciprocal Tariffs on Vietnamese Products

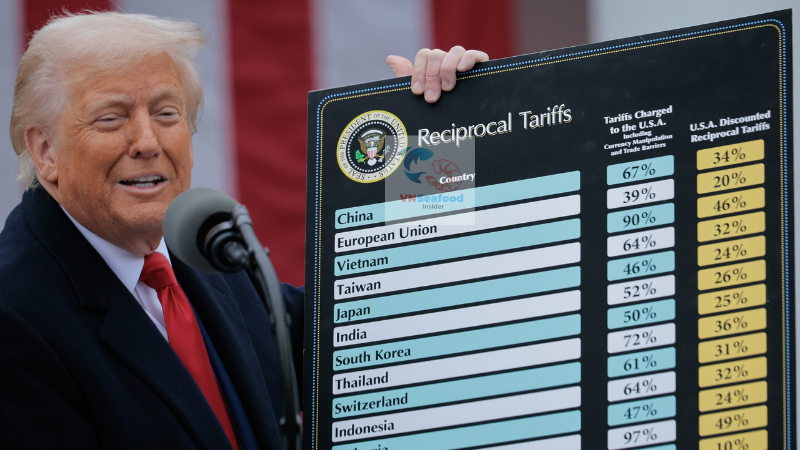

When the United States announced a reciprocal tariff on Vietnamese goods starting April 9, 2025, it caught many industry experts and business leaders by surprise. The announcement, made on April 3, represents what Michael Kokalari, Chief Economist at VinaCapital, described as “completely unexpected.” The market had anticipated a tariff of around 10%, making the 46% figure particularly shocking.

This steep tariff is part of a broader move by the US to impose reciprocal tariffs on imports from over 180 economies. The Trump administration has based this decision on what they claim is a 90% tariff that Vietnam imposes on US imports – a figure derived from an analysis of the bilateral trade deficit. However, this claim contradicts a report published by the US Trade Representative (USTR) on April 1, which stated that “the majority of US exports to Vietnam face tariffs of 15% or less.”

For context, Bloomberg and other sources suggest that Vietnam’s average tariffs on US imports are only about 7 percentage points higher than US tariffs on Vietnamese imports. When adjusted for trade-weighted flows, the two countries’ effective import taxes are roughly equivalent.

How US reciprocal tariffs impact Vietnam Seafood Industry

Immediate Reaction from the Market

The announcement sent shockwaves through Vietnam’s financial markets, with the VN-Index plunging nearly 7% as investors scrambled to assess the potential impact on the economy. The selling was fairly uniform across all sectors, indicating widespread concern about the tariffs’ effects.

For the seafood industry specifically, the impact could be particularly severe. The United States is a major, traditional market for Vietnamese seafood, accounting for approximately $2 billion in annual exports – about one-fifth of Vietnam’s total seafood export value. Over 400 Vietnamese companies currently export or plan to export seafood to the US through large, high-value orders.

Practical Implications for Seafood Exporters

The Vietnam Association of Seafood Exporters and Producers (VASEP) has raised serious concerns about how these tariffs will affect Vietnamese seafood’s competitiveness in the US market. With a 46% tariff, significantly higher than those applied to competing exporting countries (India: 26%, Ecuador: 10%, Indonesia: 32%, Thailand: 36%), Vietnamese seafood products risk losing their market position.

To put this into perspective, VASEP pointed out that a shipment of shrimp worth $500,000, which previously incurred a 5% tariff ($25,000), would now be subject to a 46% tariff ($230,000) – an increase of $205,000. This dramatic rise in costs would inevitably be reflected in the final price to American consumers, potentially making Vietnamese seafood prohibitively expensive compared to products from countries with lower tariff rates. As the result, we can see clearly how US reciprocal tariffs impact Vietnam seafood in upcoming time.

Real-World Impact on Seafood Businesses

The tariffs have already prompted many Vietnamese seafood exporters to reconsider their US market strategy. Truong Huu Thong, chairman of T&T Co., Ltd., a leading exporter of shrimp and tilapia based in Binh Thuan Province, stated bluntly that with such steep tariffs, his company would no longer be able to continue exporting seafood to the US.

Similarly, Nguyen Van Trien, director of Tan Phat Foods Corporation, which specializes in tuna exports to the US, lamented that his company’s products would not be able to compete with those from other markets under the new tariff structure. He stressed that customers would inevitably shift to buying products from countries with lower tariffs (10-30%), effectively abandoning Vietnamese products.

Read another post: Top 6 Vietnam Seafood Export Products 2024 – Market Insights and Trends 2025 -> click here.

Economic Consequences Beyond the Seafood Sector

Broader Impact on Vietnam’s Economy

These tariffs threaten to have far-reaching consequences for Vietnam’s overall economic outlook. Kokalari from VinaCapital warned that the tariffs “will make it difficult for Vietnam to achieve its 8% GDP growth target.” Given how high the initial negotiating position is, experts believe it’s hard to see a final figure of anything less than 25%, which would represent a material hit to Vietnam’s GDP growth.

The timing is particularly challenging as Vietnam has been positioning itself as an alternative manufacturing hub as companies seek to diversify their supply chains away from China. These US reciprocal tariffs impact Vietnam seafood critically and also could potentially slow this transition and impact investment decisions.

Supply Chain Disruptions

The impact extends beyond just export figures. As Trien pointed out, “The US tariff will greatly affect the company’s supply chain. If my firm’s tuna cannot be exported to the US, local fishermen will have no buyers for their catch.” This highlights how tariffs create a domino effect throughout the entire supply chain, from fishermen to processors to exporters.

According to customs data, approximately 37,500 tonnes of seafood products are currently en route to the US, and about 31,500 tonnes are scheduled for export in April and May 2025. Signed contracts for 2025 amount to about 38,500 tonnes. The timing of the tariff implementation creates immediate challenges for these shipments.

Strategies for Vietnamese Seafood Exporters to Navigate the Tariff Storm

Diversifying Export Markets

In response to the tariffs, many seafood exporters are already planning to redirect their focus to alternative markets. Thong mentioned that if the US imposes the 46% tariff, his company will temporarily halt seafood shipments to the market and focus on other emerging markets such as Europe, Japan, South Korea, Canada, and Australia.

This strategy of market diversification can help mitigate the impact of the US tariffs, though it requires establishing new business relationships and possibly adapting products to meet different market requirements. At VNSeafoodInsider, we’ve seen successful examples of companies that have pivoted to focus more on the EU market, where demand for sustainable seafood products continues to grow.

Negotiating for Reduced Tariffs

VASEP has submitted an official document to the Prime Minister and various ministries proposing a negotiation plan with the US to reduce tariffs on seafood products. The association has suggested that the government negotiate with the US to avoid applying the 46% rate universally and instead establish separate tariff rates for different product categories. Indeed, we don’t want to see US reciprocal tariffs impact Vietnam seafood seriously.

Additionally, VASEP has proposed that the Vietnamese government consider proactively reducing import tariffs to 0% on seafood imported from the US, focusing on key products such as shrimp and tuna. This gesture could create favorable conditions for negotiations with the US.

There’s some optimism that negotiations could yield results. Vu Dinh Dap, president of the Vietnam Tuna Association, advised seafood exporters to remain calm and trust in the negotiations between the two governments. Trade experts believe the 46% tariff represents an opening position for negotiations, with intense discussions expected between the two countries in the coming weeks.

See other post: How to Source High Quality Shrimp from Vietnamese Shrimp Suppliers

Enhancing Value-Added Processing

Another strategy for Vietnamese seafood exporters is to focus on increasing the value-added component of their products. By moving up the value chain – producing more processed, ready-to-eat seafood products rather than just raw materials – companies can potentially command higher prices that help offset the impact of tariffs.

This strategy also aligns with global consumer trends toward convenience foods, creating a win-win situation that could help maintain competitiveness despite the tariff barriers.

Looking Ahead: Potential Outcomes and Preparedness Strategies

Possible Scenarios for the Final Tariff Rate

While the 46% figure has created significant anxiety in the industry, it’s important to note that this likely represents an opening position for negotiations. The final rate could be lower, though experts caution that given the high initial figure, it’s unlikely to drop below 25%. This is why there is uncertainty how seriously US reciprocal tariffs impact Vietnam seafood yet.

The May 27 arrival deadline that has been reported gives some breathing room for shipments already in transit, but the uncertainty remains a major concern for the industry. Companies need to prepare for multiple scenarios, from a best case of significantly reduced tariffs to a worst case of the full 46% being implemented.

Preparedness Recommendations for Seafood Exporters

For Vietnamese seafood exporters navigating these uncertain waters, VNSeafoodInsider recommends:

- Develop a multi-market strategy: Don’t put all your eggs (or fish) in one basket. Actively cultivate relationships in alternative markets to reduce dependence on the US.

- Stay informed: The tariff situation is fluid, with negotiations ongoing. Maintain close contact with industry associations like VASEP for the latest developments.

- Review contracts and pricing: Examine existing contracts with US buyers to understand implications if tariffs are implemented. Consider price adjustment clauses for future contracts.

- Invest in product differentiation: Focus on quality, sustainability certifications, and unique product attributes that can command premium pricing to help offset tariff impacts.

- Evaluate supply chain resilience: Work with domestic suppliers to ensure they can weather potential demand fluctuations if exports to the US decrease.

Conclusion: Navigating Through Troubled Waters

The fact of US reciprocal tariffs impact Vietnam seafood is that these tariffs represent perhaps the most significant challenge to Vietnam’s seafood export industry in recent years. While the immediate outlook appears stormy, Vietnamese businesses have demonstrated remarkable resilience and adaptability in the past.

The seafood industry’s response to this challenge will likely involve a combination of market diversification, product innovation, and active engagement in the diplomatic efforts to reduce tariffs. At VNSeafoodInsider, we believe that while these tariffs present serious challenges, they also create opportunities for the industry to evolve and become more resilient through diversification.

As negotiations between Vietnam and the US continue, we’ll keep you updated on developments that could affect your seafood business. Remember, even in the choppiest waters, skilled navigators can find their way to calmer seas. The key is preparation, flexibility, and a forward-looking approach that turns challenges into opportunities for growth and transformation.

Have you been affected by the US reciprocal tariffs on Vietnam seafood? Do you have any other idea about US reciprocal tariffs impact Vietnam seafood? Share your experiences and strategies in the comments below, and let’s navigate these challenging times together.

Pingback: Why Vietnamese Shrimp Faces the Heaviest Impact Under New U.S. Tariffs

Pingback: Vietnam Seafood Exports Tariff Set at 20% After Trump Deal

Pingback: The Rise of Vietnam Seafood Processing: Trends & Future Outlook